We published an update on NVR on Nov 10, 2021. A copy of the associated Earnings Update report is here.

We published an update on CMI on August 11, 2021. A copy of the associated Earnings Update report is here.

We published an update on LEA on May 12, 2021. A copy of the associated Earnings Update report is here.

The real earnings season has begun. While earnings reports garner lots of attention, they are unaudited and lack the financial footnotes that investors need to truly understand a company’s profitability. The footnotes can only be found in annual 10-K filings – where we focus.

Among the very first firms to file 2018 10-Ks are three companies we’ve previously featured as Long Ideas that we like even more after reviewing their latest 10-Ks. Lear Corp (LEA: $157/share), NVR Inc. (NVR: $2,600/share), and Cummins Inc. (CMI: $155/share) are this week’s Long Idea.

Track Record of Outperformance

These three stocks share a few characteristics that made them top picks in the past and help make them even higher conviction ideas today. They all

- Tie executive compensation to return on invested capital (ROIC), the primary driver of valuation.

- Outperformed the S&P 500 since our original articles.

- Grew their economic earnings per share in 2018 – a year in which economic earnings declined across the broader market.

- Have better economic earnings than reported earnings.

- Have a price to economic book value (PEBV) below 1, which means that the market is pricing in a permanent decline in cash flows for each of them.

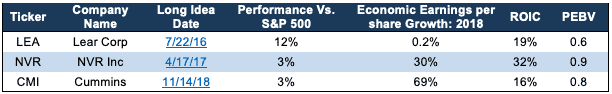

Figure 1 shows details on the performance and fundamentals of these three stocks.

Figure 1: Performance and Fundamentals for LEA, NVR, and CMI

Sources: New Constructs, LLC and company filings

Lear Corp (LEA)

Lear, an automotive parts manufacturer, has been a model of consistency by earning an ROIC between 19-20% in each of the past three years. This consistency can be attributed to LEA tying two-thirds of long-term executive bonuses to ROIC.

Even though economic earnings per share grew at a modest 0.2% in 2018, they have grown in five consecutive years and seven out of the past eight years.

This steady growth in profits has helped LEA outperform the market (up 40% vs 28% for the S&P) since we first made it one of our top picks on 7/22/16.

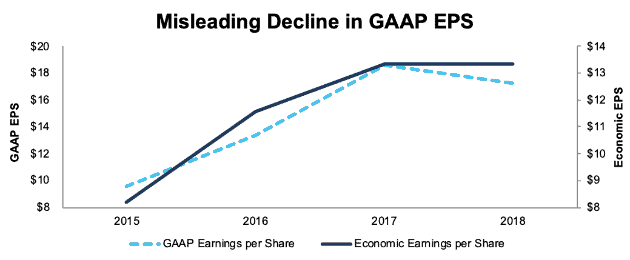

Even though the stock has outperformed since our article, it underperformed significantly in 2018, falling over 30%. This underperformance may be due to investors focusing too much on the 7% decline in GAAP earnings per share in 2018, as shown in Figure 2.

Figure 2: GAAP vs. Economic EPS for LEA: 2013-2018

Sources: New Constructs, LLC and company filings

The disconnect between GAAP and economic EPS is explained by two main adjustments:

- 2017 GAAP earnings were artificially inflated by a $115 million (1% of revenue) benefit from the tax law.

- 2018 GAAP earnings were artificially deflated by $88 million in restructuring costs and a $4 million increase in inventory reserves.

These adjustments show that LEA maintained a steady level of profitability in 2018 even though GAAP EPS shows a significant decline.

The decline in accounting earnings make LEA’s business looks worse than it really is. The market certainly has low expectations for the company’s future profits. At its current price of $157/share, LEA has a PEBV of 0.6, which means the market expects after-tax operating profit (NOPAT) to permanently decline by 40%. That expectation seems overly pessimistic for a company with LEA’s track record of profit growth.

If LEA can grow NOPAT by just 3% compounded annually for the next five years, the stock is worth $314/share today, a 98% upside from the current stock price. See the math behind this dynamic DCF scenario.

Even though LEA has outperformed in the past, the stock remains undervalued and still has significant upside for investors.

NVR Inc (NVR)

We first featured homebuilder NVR on 4/17/17. We believed that investors were overly pessimistic about the housing market, and that NVR, as the most profitable company in the industry, was well positioned to exceed the market’s low expectations for its future cash flows.

Our thesis has proven correct so far, as NVR is up 22% vs. the S&P 500 up 18% since our original article. NVR, which ties long-term executive compensation to ROIC, has also widened its advantage over its peers as the most profitable company in the industry. When we wrote our original article, NVR earned an ROIC of 21% compared to a 5% peer average. Currently, NVR earns a 32% ROIC compared to an 8% peer average.

Unlike with LEA, NVR did grow GAAP earnings significantly in 2018. A $63 million (1% of revenue) non-recurring charge due to tax reform lowered its reported earnings in 2017, which leads to a 54% increase in GAAP EPS in 2018.

However, investors that accounted for the impact of the tax charge but missed the $7 million write-down (hidden in cost of sales) in 2018 will still underrate NVR’s profit growth. This non-recurring charge overstates expenses and leads to NVR reporting a 13% increase in pre-tax operating income when true pre-tax operating profit grew by 14%.

Investors still seem to be pricing in a serious decline in the housing market that contradicts NVR’s solid growth in 2018. Even though the housing market slowed in 2018, falling mortgage rates and rising wages have led homebuilders to express confidence in the state of their industry.

At its current price of $2,600/share, NVR has a PEBV of 0.9. This ratio means the market expects NVR’s NOPAT to permanently decline by 10%. That expectation seems overly pessimistic for a company that was able to grow NOPAT at 1% compounded annually since the previous market peak in 2006.

If NVR can replicate that 1% compounded annual NOPAT growth rate over the next 12 years, the stock is worth ~$3,200/share today, a 22% upside from the current stock price. See the math behind this dynamic DCF scenario.

Even if you believe the housing market is about to experience a crash that’s just as bad as the ’07-’08 crash, NVR remains undervalued.

Cummins, Inc. (CMI)

Cummins, which manufactures engines and other components for heavy trucks, has the fastest growing economic earnings per share among these three stocks. We featured the stock just three months ago on 11/14/18. Since our original long idea (featured in Barron’s), the stock is up 6% while the S&P 500 is up 3%.

Like NVR and LEA, CMI ties a significant portion of executive compensation to ROIC, a change that it implemented just last year. This superior corporate governance represents an underrated competitive advantage.

In our original Long Idea, we highlighted three major adjustments:

- a one-time $782 million (3% of revenue) charge from tax reform in Q4 2017 and

- non-recurring expenses in Q1 and Q2 2018 that added up to $368 million (2% of revenue) due to field campaigns to repair older model engines that failed emissions tests.

These unusual charges led to CMI having reported earnings of $1.3 billion compared to $2.2 billion in NOPAT

CMI filed its 2018 10-K on February 11, and while we didn’t find any items as big as those, we did identify a handful of smaller adjustments that make NOPAT higher than GAAP net income.

- On page 83, the removal of an additional $12 million in non-operating tax expense in 2018 as the company continues to account for the impact of tax reform.

- On page 87, an adjustment for the impact of a $5 million increase to the company’s LIFO reserve.

- On page 29, the company disclosed that it adopted the new pension cost accounting rule that reclassified components of pension cost from operating to non-operating income. In 2017, CMI earned $31 million in non-operating income from these items, but with the new rule these items are no longer distorting reported operating income.

CMI reported $2.1 billion in GAAP net income in 2018, but our adjustments show that they earned $2.4 billion in NOPAT. Meanwhile, reported operating income increased by 19% from 2017, but our adjustments show that net operating profit before tax (NOPBT) grew by 36%.

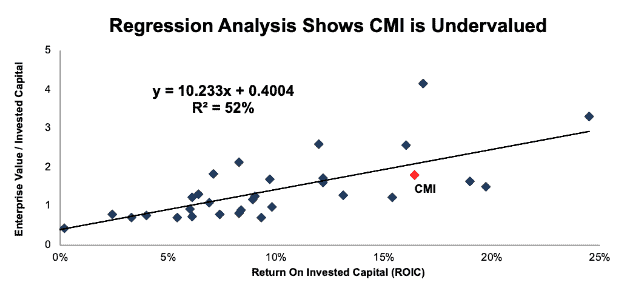

Due to the strong profits revealed in its 10-K, CMI looks even more undervalued than it did in our original article. When we first compared the stock to its 32 peers in the Auto, Truck, and Motorcycle Parts industry, we found that CMI’s ROIC implied it was undervalued by 7%. Figure 3 shows that, based on its 2018 ROIC of 16%, CMI would be worth $183/share, or 18% upside, if it traded at parity with its peers. We would argue that the company deserves a premium valuation based on its leading market share and superior corporate governance.

Figure 3: ROIC Explains 52% of Valuation for Auto, Truck and Motorcycle Parts Stocks

Sources: New Constructs, LLC and company filings

Figure 3 also implies that the market expects CMI’s ROIC to decline from 16% to 13%. This implied decline is in line with the stock’s PEBV of 0.8, which means the market expects a permanent 20% decline in NOPAT.

We believe the market’s expectation is far too low for a company that has grown NOPAT by 11% compounded annually over the past decade. It’s true that truck orders have dropped off significantly in recent months, but that appears to be more due to a nearly year-long backlog of orders than any real decrease in demand.

Even if expectations for slower growth come to fruition, CMI still has significant upside. If the company grows NOPAT by just 2% compounded annually over the next decade, the stock is worth $223/share today, a 44% upside from the current stock price. See the math behind this dynamic DCF scenario.

Even if CMI never grows NOPAT again, its economic book value (i.e. zero-growth value) is $190/share, a 23% upside from the current stock price.

We were already bullish on CMI, but after digging into its 10-K, our conviction has only increased.

This article originally published on February 20, 2019.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

3 replies to "Three Outperforming Stocks That Look Better than Ever"

Great analysis. Do you have any bank related ones? Thanks!

Yes, you can see some of our Long Ideas on bank stocks here and here

1st time reading, try to understand, wish had known you earlier,song