We published an update on this Long Idea on August 11, 2021. A copy of the associated Earnings Update report is here.

We’re often skeptical when companies make big acquisitions, and for good reason. Study after study shows that mergers and acquisitions destroy value for shareholders somewhere between 70%-90% of the time. Misaligned incentives often encourage companies to overpay for businesses on the premise of “combined synergies” that never materialize.

However, this firm has shown an ability to create value through acquisitions in its past, and we expect it to succeed with its upcoming acquisition as well.

Real potential synergies from vertical integration, a reasonably valued purchase price, and corporate governance that aligns with shareholder’s interests makes CVS Health (CVS: $73/share) this week’s Long Idea.

Track Record of Value-Creating Acquisitions

CVS recently won approval from the Department of Justice for its proposed $69 billion acquisition of health insurer Aetna (AET). The merger will turn CVS into a vertically integrated healthcare provider that buys pharmaceuticals through its Pharmacy Benefit Management (PBM) business, insures patients through Aetna, and dispenses drugs and provides treatment at its drugstores and MinuteClinics.

Many companies struggle to integrate large acquisitions, but CVS has demonstrated its ability to succeed with large vertical integrations in the past. In 2007, CVS – which was at the time primarily just a drugstore chain – acquired Caremark, one of the largest PBM’s in the US.

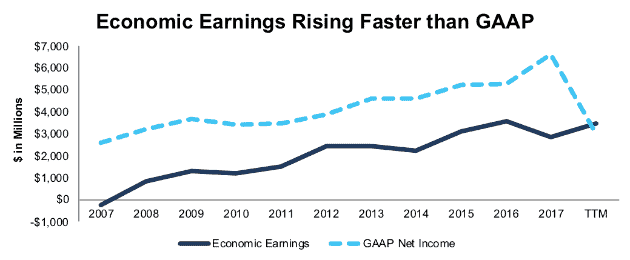

CVS’s stock dropped when it announced the deal as investors were skeptical of the proposed synergies. However, Figure 1 shows that in the decade since the merger was completed, CVS has increased its economic earnings – the true cash flows of the business – from -$230 million to $3.5 billion.

Figure 1: CVS’s Economic Earnings and GAAP Net Income Since 2007

Sources: New Constructs, LLC and company filings

GAAP earnings understate the increase in CVS’ profitability since the Caremark acquisition as well. Specifically, a $3.9 billion (2% of revenue) non-cash write-down earlier this year artificially decreased trailing twelve months (TTM) GAAP net income.

Management Incentives Are Aligned with Shareholders

As we discussed in the intro to this piece, many acquisitions fail because executive interests are not aligned with the real driver of shareholder value: return on invested capital (ROIC). When executive’s bonuses are tied to metrics such as GAAP earnings or EBITDA, they might pursue acquisitions that improve those metrics but hurt ROIC.

CVS does not tie executive compensation directly to ROIC, but it does use a similar metric, Return on Net Assets (RoNA). RoNA uses net operating profit after tax (NOPAT) as the numerator, just like ROIC, but it uses Adjusted Average Net Assets as the denominator. Adjusted Average Net Assets is similar to our Invested Capital metric, but it does not make many of the adjustments we do for items such as off-balance sheet debt, accumulated other comprehensive income, deferred compensation and others.

CVS would be better off using ROIC, but RoNA at least incentivizes executives to pay attention to capital allocation. The fact that long-term stock grants are tied to RoNA should give investors confidence that executives have the right interests (shareholders’) at heart when it comes to this acquisition.

The Price Is Right

The other reason most acquisitions fail is that acquiring companies almost always overpay. A high price tag can doom a deal from the start, even if the two companies integrate seamlessly and have significant synergies.

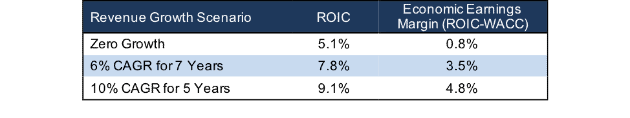

Fortunately, CVS does not appear to be overpaying for Aetna. At the acquisition price of $207/share, CVS will invest ~$79 billion (when accounting for debt and other liabilities) to gain ~$4 billion in TTM NOPAT, which means the deal earns an ROIC of 5.1%.

CVS has a weighted average cost of capital (WACC) of 4.3%, so even without synergies this deal should be accretive to economic earnings. As Figure 2 shows, it won’t take much growth in profitability for the Aetna acquisition to meet or even exceed CVS’s current ROIC of 7.8%. If Aetna can maintain TTM margins of 6.7% and grow revenue by 6% compounded annually for seven years (roughly in line with projected healthcare spending growth), the acquisition will earn a 7.8% ROIC.

Figure 2: Implied Acquisition ROIC’s Based on Growth Scenarios

Sources: New Constructs, LLC and company filings.

If the impact of vertical integration can help Aetna gain market share and grow revenue by 10% compounded annually for five years, the deal could earn an ROIC of 9.1%, higher than CVS’s current ROIC and more than double its WACC.

Skeptics will argue that Aetna’s margins have been unusually high in the TTM period and should regress, but even if pre-tax margins decline, the impact of the tax cut – which reduced its effective tax rate from 35% to 27% – should allow it to maintain current after-tax margins.

Vertical Integration Creates Significant Advantages

Once CVS completes the Aetna acquisition, it will become the only vertically integrated healthcare company with a major market share in the PBM, health insurance, and retail pharmacy space.

Other competitors have major market shares in two of those three segments. For instance, UnitedHealth Group (UNH) is the largest health insurer in the country and its OptumRx business is the third largest PBM, but its pharmacy business is less than a quarter the size of CVS’s. The recently approved Cigna (CI) and Express Scripts (ESRX) merger will create a similar entity with integration in two out of the three points of the chain.

CVS’s unique vertical integration means it will be managing patient’s health from the backend of purchasing drugs all the way to the point of contact. This integration provides a number of significant advantages, including:

- Aligning Incentives: Misaligned incentives represent one of the largest inefficiencies in the current pharmaceutical value chain. PBM’s earn a significant amount of their revenue in the form of rebates from drug manufacturers, so they sometimes have an incentive to choose more expensive drugs over ones that would be cheaper for insurers and pharmacies. Pharmacies may tend to overprescribe as long as insurers will cover the costs. By putting all three segments under the same umbrella, CVS can focus on aligning everyone’s incentives around providing the best quality care at the cheapest price.

- Superior Data: Post acquisition, the company will have data about patients’ claims history, pharmacy usage, prescription data, and many more data points that it can combine to get a more complete picture of patient care. In the past, these datasets may have been siloed, or even if they were shared, they would use different nomenclatures or structures that made cross analysis impractical.

- Retail Sales: Even outside of the healthcare space, this deal could provide a boost to CVS’s retail operation, which brings in ~$20 billion in revenue annually (11% of total revenue) and has a higher margin than the rest of the business. If CVS provides incentives for Aetna customers to pick up their prescriptions in its pharmacies, those customers might also pick up some groceries, beauty products, or other small items while they’re in the store.

The first two advantages – aligning incentives and aggregating data across business units – should allow CVS to provide a higher quality of care at a lower price. They give CVS unique capabilities versus existing competitors and potential new entrants into the industry.

The third advantage enables CVS to make more money and serve more customers than standalone insurers/PBM’s or online only pharmacies. The incremental value of retail revenue and touch points can subsidize healthcare costs and allow CVS/Aetna to offer more competitive premiums and prescription prices.

Threat from Amazon Is Overhyped

Amazon (AMZN) has been the looming threat in the pharmacy industry over the past two years. The e-commerce giant continues to make noise about potential plans to enter the pharmacy space. CVS stock dropped 8% in June after Amazon announced its acquisition of online pharmacy startup PillPack.

While no one wants to compete with Amazon, we’ve argued in our micro-bubble piece that its power to disrupt industries has been overhyped. Many brick and mortar retailers continue to thrive, and the barriers to entry in the pharmacy space are significantly higher.

For starters, Amazon’s biggest impact was on poorly run retailers – such as Sears (SHLD) – that underinvested in their stores and created a poor shopping experience. There doesn’t appear to be that same low-hanging fruit in the pharmacy industry, as brick-and-mortar pharmacies have some of the highest customer satisfaction scores of any industry.

In addition, physical locations provide a significant advantage for pharmacies. They allow patients to pick up prescriptions immediately rather than have to wait for delivery, and they can also provide simple forms of preventative care like screening and vaccinations. While Amazon does have some brick-and-mortar locations with its acquisition of Whole Foods, its roughly 500 locations pale in comparison to CVS’s ~9,800.

Finally, CVS’s back-end integrations give it an advantage that will be difficult to replicate. Amazon’s supply-chain expertise may translate to the pharmacy space, but it has no real experience or advantage that would allow it to compete in the insurance or PBM space. The same goes for other retailers such as Walmart (WMT) that have considered moving more heavily into the healthcare industry.

Improving ROIC Correlated with Creating Shareholder Value

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC. The technology that enables this research is featured by Harvard Business School.

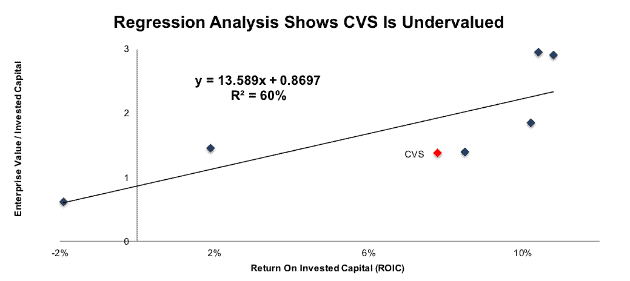

Per Figure 3, ROIC explains 60% of the difference in valuation for the 7 pharmacies/PBM’s under coverage. CVS’s stock trades at a significant discount to peers as shown by its position below the trendline.

Figure 3: ROIC Explains 60% Of Valuation for Pharmacies and PBM’s

Sources: New Constructs, LLC and company filings

If the stock were to trade at parity with its peer group, it would be worth $122/share – a 68% upside to the current stock price. This is not a perfect peer group since CVS’s business is fairly unique, so it might deserve to trade at a discount compared to a company with more of a health insurance focus like UNH in the top right corner. Still, it’s hard to believe that CVS deserves to trade this far below its peers.

CVS Is Priced for 30% Profit Decline

Despite the strong fundamentals, CVS remains cheap, even though traditional metrics would show otherwise. At its current price of $73/share, CVS has a P/E ratio of 25, roughly in line with the S&P 500. As we noted above, CVS’s GAAP earnings understate its true profitability.

When we analyze the cash flow expectations baked into the stock price, we find that CVS is significantly undervalued. At its current price of $73/share, CVS has a price-to-economic book value (PEBV) ratio of 0.7. This ratio means the market expects CVS’s NOPAT to permanently decline by 30%.

This expectation seems rather pessimistic given that CVS has grown NOPAT by 7% compounded annually over the past decade.

Such pessimistic expectations create large upside potential. If we assume that CVS can successfully integrate the Aetna acquisition next year, maintain 2017 pre-tax margins of 6%, and grow revenue at a long-term rate of 3.5% compounded annually for 10 years, the stock is worth $195/share today, a 167% upside from the current price. See the math behind this dynamic DCF scenario.

That may seem like a wildly optimistic price target, but it doesn’t require a major improvement in CVS’s business. In fact, in that DCF scenario the company has the same ROIC in year 10, 7.8%, that it has today.

What Noise Traders Miss with CVS

In general, today’s markets tend to overlook intelligent capital allocation and shareholder-friendly corporate governance. Instead, due to the proliferation of noise traders, markets are great at amplifying risk as momentum stocks get pushed higher and high-quality fundamental research is downplayed. Here are just a few points that noise traders would miss when analyzing CVS:

- Long-term profit growth – GAAP earnings understate the company’s profit growth since the Caremark acquisition.

- Competitive advantage – Noise traders fall prey to the “Amazon effect” and assume CVS is doomed if Amazon enters its industry. In this way, it’s similar to some of our micro-bubble winners.

- Undervalued stock price – CVS’s P/E ratio looks average relative to the overall market, but as we know, P/E ratios are not a good measure of value.

Acquisition Growth Can Send Shares Higher

As the title of this piece states, we see the Aetna acquisition as the primary catalyst for CVS. The deal should boost economic earnings immediately, and it could deliver significant synergies in the near-term. The combined company could certainly beat analyst earnings expectations, which should send shares higher.

Longer term, the company should see its PEBV grow as its advantages and resilience to competition become more apparent. If the market gives the company a PEBV of 1.2 – like it had in 2014 before the Amazon threat was as pronounced – that would provide significant upside even without any profit growth.

Tax Reform Should Provide a Boost

CVS stands to benefit to an unusually large degree from the corporate tax cuts. It pays an unusually high cash tax rate of 38%, and it earns substantially all of its revenue within the U.S. The company expects its effective tax rate to fall to 27% in 2018, which would boost NOPAT by ~$1.2 billion (18%).

As noted above, Aetna should also get a significant boost from the corporate tax cuts. This increased cash flow should help the combined company invest in the data and back-end infrastructure it needs to successfully integrate its businesses while also potentially returning more capital to shareholders.

Dividend Offers Safe 2.7%

CVS has increased its dividend in each of the past 15 years, although that streak will end this year as the company has frozen its dividend in advance of the Aetna merger. Its annualized dividend has grown from $0.50/share in 2011 to $2.00/share in 2017, or 26% compounded annually. The current dividend provides a 2.7% yield. Best of all, CVS generates the necessary cash flow to continue paying its dividend. Since 2011, CVS has generated a cumulative $22.7 billion (30% of market cap) in free cash flow while paying about $9.4 billion in dividends.

In addition to dividends, CVS has the ability to return capital to shareholders through share repurchases. Over the past several years, the company has bought back $4-$5 billion in shares each year. However, with the added debt from the Aetna acquisition, the company plans to suspend buyback activity until it can reduce its leverage ratio after the acquisition is completed. If the company eventually resumes buying back stock at the same rate, the combined buybacks and dividend will offer ~8.6% yield.

Insider Trading and Short Interest Are Minimal

Insider activity has been minimal over the past 12 months, with 97 thousand shares purchased and 200 thousand shares sold for a net effect of 103 thousand shares sold. These sales represent less than 1% of shares outstanding.

There are currently 58.5 million shares sold short, which equates to 6% of shares outstanding and 7.3 days to cover. The days to cover number is slightly high, but that reflects relatively low trading volumes more than high short interest.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[1] findings in CVS Health’s fiscal 2017 10-K:

Income Statement: we made $5.5 billion of adjustments, with a net effect of removing $250 million in non-operating expense (1% of revenue). We removed $2.6 billion in non-operating income and $2.9 billion in non-operating expenses. You can see all the adjustments made to CVS’s income statement here.

Balance Sheet: we made $26.9 billion of adjustments to calculate invested capital with a net increase of $26.9 billion. The most notable adjustment was $19.5 million in operating leases. This adjustment represented 30% of reported net assets. You can see all the adjustments made to CVS’s balance sheet here.

Valuation: we made $122 billion of adjustments with a net effect of decreasing shareholder value by $53 billion. Despite this decrease in shareholder value, CVS remains undervalued.

Attractive Funds That Hold CVS

The following funds receive our Attractive-or-better rating and allocate significantly to CVS Health.

- iShares US Healthcare Providers ETF (IHF) – 6.7% allocation and Attractive rating.

- Ivy Focused Value NextShares (IVFVC) – 4.9% allocation and Very Attractive rating.

- Fidelity Select Health Care Services Portfolio (FSHCX) – 4.8% allocation and Very Attractive rating.

- Parnassus Core Equity Fund (PRILX) – 4.7% allocation and Very Attractive rating

This article originally published on October 17, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.