Editor’s Note: Since we published this report, HollyFrontier changed its name and ticker to HF Sinclair Corporation (DINO).

We closed JBSS on May 17, 2023. A copy of the associated Position Close report is here.

We published an update on UHS on March 2, 2022. A copy of the associated Earnings Update report is here.

We published an update on HFC on March 2, 2022. A copy of the associated Earnings Update report is here.

We closed the DRI position on March 12, 2021. A copy of the associated Position Update report is here.

Since mid-April, we’ve identified several companies with strong underlying core earnings and valuations implying profits would never recover from COVID-induced lows.

Our “See Through the Dip” thesis acknowledges that most of these firms’ profits will decline in the short term, however, their strong balance sheets and industry leading profitability before COVID will enable them not just to survive the economic downturn, but also thrive in a recovery. Investors should avoid putting more capital into crowded passive strategies and consider our “See Through The Dip” stocks.

John B. Sanfilippo & Son (JBSS: $90/share), Universal Health Services (UHS: $112/share), and HollyFrontier Corp (HFC: $26/share) are three stocks previously featured that remain particularly undervalued. These three stocks are this week’s Long Ideas.

See Through the Dip to Find Value

Figure 1 shows that four out of the eight Long Ideas published since our last “See Through the Dip” update have outperformed the S&P 500 since being published. See Appendix I for the performance of all the See Through the Dip stocks.

Figure 1: See Through the Dip Stocks Vs. S&P 500 – Prices through August 18, 2020

Sources: New Constructs, LLC and company filings.

These eight stocks are not only undervalued, but the underlying businesses are strong and ready to grow in the economic recovery. Further, each company shares the following:

- Strong cash position to weather a prolonged downturn

- Positive and rising core earnings

- Superior and/or faster rising return on invested capital (ROIC) compared to peers

- Strong market position in their respective industry

- Valuations that imply profits never recover

Investors looking for long-term-value-creating stocks in this market should start here.

John B. Sanfilippo & Son, Inc. (JBSS) –Very Attractive Rating

We made John B. Sanfilippo & Son, Inc. a Long Idea on July 13, 2020. Since then, the stock is up ~3% (S&P 500 +7%). While the stock has underperformed, the fundamentals of the business give it plenty more upside potential.

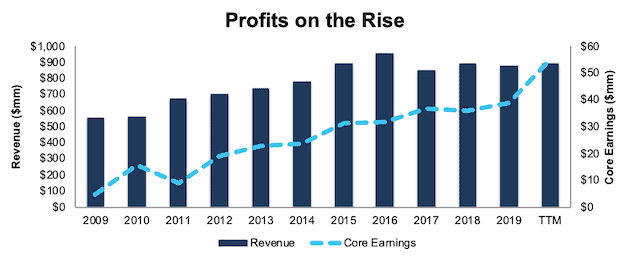

Over the past decade, John B. Sanfilippo & Son has grown revenue by 5% compounded annually and core earnings by 23% compounded annually, per Figure 2. Longer term, the firm has increased core earnings by 18% compounded annually over the past two decades. John B. Sanfilippo & Son increased its core earnings margin from <1% to 6% over the same time.

Figure 2: Revenue & Core Earnings Since 2009

Sources: New Constructs, LLC and company filings

John B. Sanfilippo & Son’s rising profitability helps the business generate positive free cash flow (FCF) in eight of the past ten years and a cumulative $200 million (20% of market cap) over the past five years. John B. Sanfilippo & Son’s $60 million in FCF over the TTM period equates to a 5% FCF yield, which is higher than the Consumer Non-cyclicals sector average of 4%.

Profitability Is Tops Amongst Peers

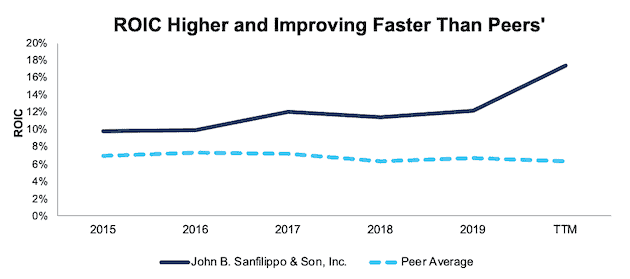

Before the COVID-19 pandemic, John B. Sanfilippo & Son’s profitability was trending higher while peers’ was declining.

John B. Sanfilippo & Son’s net operating profit (NOPAT) margin improved from 4% in 2015 to 7% in 2019, while the market-cap-weighted average NOPAT margin of the firm’s peers rose at a slower rate from 11% to 12% over the same time. This peer group includes the Kraft Heinz Co. (KHC), J&J Snack Foods (JJSF), Kellogg Company (K), General Mills (GIS), and 18 other packaged food companies.

John B. Sanfilippo & Son’s capital efficiency is well above its peer group. The firm improved its invested capital turns from 2.5 in 2015 to 2.7 in 2019, while the market-cap-weighted average invested capital turns of its peer group fell from 0.7 to 0.6 over the same time.

The combination of rising margins and invested capital turns drives John B. Sanfilippo & Son’s ROIC higher. The firm improved its ROIC from 3% in 2015 to 11% in 2019. Per Figure 3, the market-cap-weighted average ROIC of peers actually fell from 7% to 6% over the same time.

Figure 3: John B. Sanfilippo & Son ROIC vs. Peers

Sources: New Constructs, LLC and company filings

JBSS Still Has Upside Potential

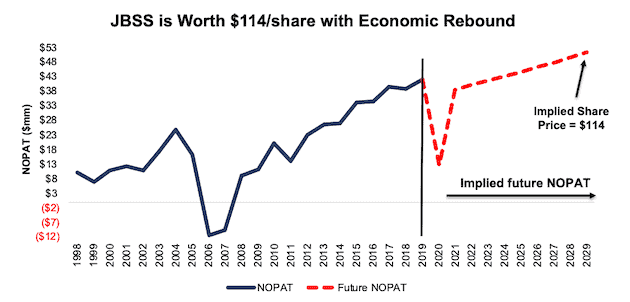

At its current price of $90/share, JBSS has a price-to-economic book value (PEBV) ratio of 0.6. This means the market expects John B. Sanfilippo & Son’s after-tax profit (NOPAT) to permanently decline by 40%. This expectation seems overly pessimistic for a firm that has grown NOPAT by 14% compounded annually over the past decade.

Using historical revenue declines, historical margins, and average historical GDP growth rates, we can model a scenario that assumes the global economy rebounds and returns to growth starting in 2021. In this scenario, we assume:

- NOPAT margins fall to 1.7% (lowest in company history, excluding negative margin in 2006/2007) in 2020 and rise to 5% (equal to 2019, compared to 7% TTM) in 2021 and each year thereafter

- Revenue falls 13% (double the YoY revenue decline in 2007) in 2020

- Revenue grows by 4.7% in 2021 and 4.8% in 2022 (consensus estimates), and 3.5% a year in 2023 and each year thereafter, which is equal to the average global GDP growth rate since 1961

In this scenario, John B. Sanfilippo & Son’s NOPAT grows by only 2% compounded annually over the next decade (including a 70% YoY drop in 2020) and the stock is worth $114/share today – a 27% upside to the current price. See the math behind this reverse DCF scenario.

For comparison, John B. Sanfilippo & Son grew NOPAT by 15% compounded annually from 2008 to 2019 and 10% compounded annually over the past two decades. It’s not often investors get the opportunity to buy a strong firm in a growing industry at such a discounted price.

Figure 4 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 4: Implied Profits Assuming Moderate Recovery Mean Big Upside Potential

Sources: New Constructs, LLC and company filings

Universal Health Services, Inc. (UHS) –Attractive Rating

We made Universal Health Services a Long Idea on July 22, 2020. Since then, the stock is up ~6% while the S&P 500 is up 4%. We believe the firm’s fundamentals, along with its ability to provide behavioral health services as the economy recovers, presents a great opportunity for this stock to outperform the S&P 500 going forward.

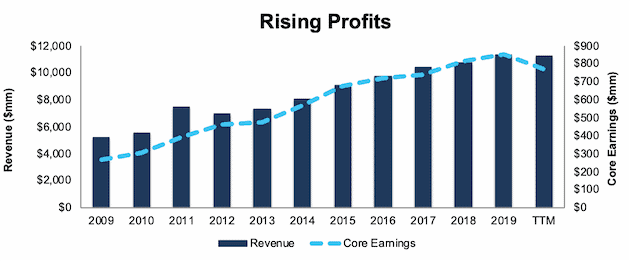

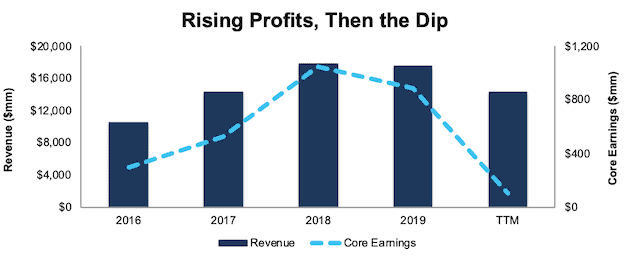

Over the past decade, Universal Health Services grew revenue by 8% compounded annually and core earnings by 12% compounded annually. The firm increased its core earnings margin from 4% in 1999 to 7% TTM.

Per Figure 5, the drop in profits over the TTM period is what we call “the dip” and is in line with our expectations for COVID-19’s impact on the overall economy. In our original report, we evaluated a worst-case scenario where Universal Health Services’ NOPAT declines 2% compounded annually from 2019 to 2029 (including a 60% YoY drop in 2020). This scenario seems very unlikely given the firm’s presence in high-growth localities and the aging demographics of America.

Figure 5: Universal Health Services Profitability Growth Since 2009

Sources: New Constructs, LLC and company filings

Universal Health Services’ improving profitability helps the business generate significant FCF. The company generated positive FCF in nine of the past 10 years and a cumulative $2.2 billion (23% of market cap) over the past five years. Universal Health Services’ $1.2 billion in FCF over the TTM equates to an 8% FCF yield, which is significantly higher than the Health Sector average of -1%.

Profitability Stands Out Among Peers

Universal Health Services’ superior profitability positions it to take the market share lost by weaker operators and return to pre-crisis profit growth when the pandemic subsides.

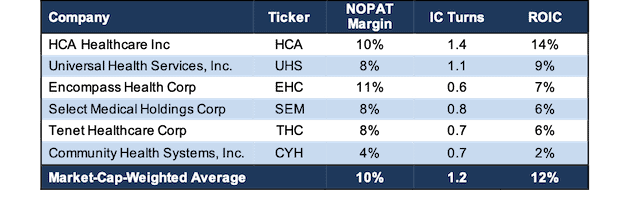

While Universal Health Systems’ NOPAT margin of 8% ranks fourth amongst peers, its invested capital turns are superior to all but one of its peers – HCA Healthcare Inc (HCA), which we made a Long Idea in June. Peers include HCA, Tenet Healthcare Corp (THC), Community Health Systems, Inc. (CYH), Select Medical Holdings Corp (SEM), and Encompass Health Corp (EHC).

Per Figure 6, Universal Health Services’ achieves a high ROIC relative to peers.

Figure 6: Universal Health Services’ Profitability vs. Competitors

Sources: New Constructs, LLC and company filings

UHS Trades at a Discount

Despite entering the current crisis from a position of strength, UHS is down 20% YTD and now trades at its cheapest PEBV ratio (0.8) in the history of our model, which begins in 1998. This ratio means the market expects Universal Health Services’ NOPAT to permanently decline by 20%. This expectation seems overly pessimistic over the long term.

Below, we use our reverse DCF model to see what the stock could be worth given conservative assumptions about COVID-19’s impact on the economy and Universal Health Services’ future growth in cash flows.

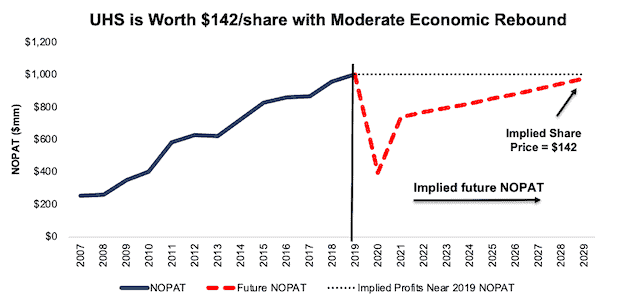

If we assume the global economy rebounds and returns to growth starting in 2021, UHS is highly undervalued.

In this scenario, we assume:

- NOPAT margin falls to 5% (company low in 1999, compared to 9% 2019) in 2020 and increases to 8.5% (10-year average) in 2021 and each year thereafter

- Revenue falls 31% (equal to the firm’s YoY acute care admission decline in April) in 2020

- Sales begin growing again in 2021, but only at 3.5% a year, which is the average global GDP growth rate since 1961

In this scenario, Universal Health Services’ NOPAT falls by less than 1% compounded annually over the next decade (including a 60% YoY drop in 2020) and the stock is worth $142/share today – a 27% upside to the current price. See the math behind this reverse DCF scenario.

For comparison, Universal Health Services has grown NOPAT by 7% compounded annually over the past five years and 11% compounded annually over the past decade. It’s not often investors get the opportunity to buy an industry leader at such a discounted price.

Figure 7 compares the firm’s implied future NOPAT to its historical NOPAT in scenario 2. This moderate scenario implies that a decade from now, Universal Health Services’ NOPAT will only be 2% above 2018 levels and 3% below 2019 levels. If profits return to these levels in less than 10 years, UHS has even more upside potential.

Figure 7: Implied Profits Assuming Moderate Recovery Give UHS Significant Upside

Sources: New Constructs, LLC and company filings

HollyFrontier Corp (HFC) –Attractive rating

We made HollyFrontier a Long Idea on July 8, 2020. Since then, the stock is down 7% (S&P 500 +7%). The underlying fundamentals of the business give it plenty more room to grow in an economic recovery and outperform the S&P 500.

HollyFrontier has a strong history of generating profits. From 2016 to 2019, HollyFrontier grew revenue by 18% compounded annually and core earnings by 44% compounded annually, per Figure 8. The firm increased its core earnings margin from 3% to 5% over the same time.

The decline in core earnings over the TTM is evidence of the impact COVID-19-driven disruptions have had on HollyFrontier’s business and is in line with our “See Through the Dip” thesis. In our original report, we evaluated a worst-case scenario where HollyFrontier’s NOPAT declines 9% compounded annually for 7 years after the pandemic (including an 88% YoY drop in 2020). This scenario seems highly unlikely given the firm’s middleman advantage in the energy market and the expected rise global oil demand through 2030.

Figure 8: HollyFrontier’s Revenue & Core Earnings Since 2016

Sources: New Constructs, LLC and company filings

The current downward profit trend is temporary, not permanent, and masks HollyFrontier’s long-term ability to generate significant free cash flow (FCF). The company generated positive FCF in seven of the past 10 years and a cumulative $1.1 billion (26% of market cap) in FCF over the past five years. HollyFrontier’s $663 million in free cash flow over the TTM period equates to an 8% FCF yield, which is higher than the Energy sector average of 6%.

Superior and Improving ROIC

COVID-driven disruptions to the energy industry have already driven financially weaker operators out of business. HollyFrontier’s profitability was growing at a faster rate than its competitors before the crisis, and the firm is well-positioned to return to profit growth when the economy recovers.

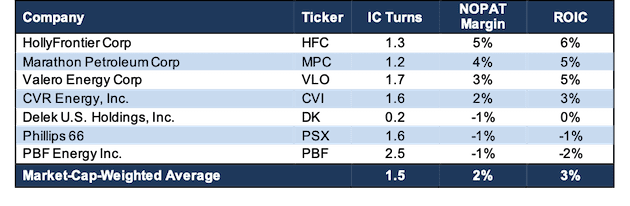

HollyFrontier’s NOPAT margin have improved from 1% in 2016 to 5% TTM. The market-cap-weighted average NOPAT margin of the firm’s peer group has fallen from 4% to 2% over the same time. This peer group consists of six other independent refiners including Phillips 66 (PSX), Marathon Petroleum Corp (MPC), Valero Energy Corp (VLO), CVR Energy (CVI), Delek U.S. Holdings, Inc. (DK), and PBF Energy Inc. (PBF).

HollyFrontier’s capital efficiency has improved over the past three years as well. The firm improved its invested capital turns from 1.2 in 2016 to 1.3 TTM, while the market-cap-weighted average invested capital turns of its peer group fell from 1.7 to 1.5 over the same time.

The combination of high and rising margins and improved invested capital turns drive HollyFrontier’s improved ROIC. The firm improved its ROIC from 2% in 2016 to 6% TTM whereas the market-cap-weighted average ROIC of HollyFrontier’s peer group fell from 7% to 3% over the same time. Per Figure 9, HollyFrontier’s ROIC of 6% ranks best amongst its peers and is more than double the peer average.

Figure 9: HollyFrontier’s Invested Capital Turns, NOPAT Margin & ROIC vs. Peers

Sources: New Constructs, LLC and company filings

HFC Remains Undervalued

At its current price of $26/share, HFC has a PEBV ratio of 0.5. This means the market expects HollyFrontier’s NOPAT to permanently decline by 50%. This expectation seems overly pessimistic over the long term. For reference, HollyFrontier grew NOPAT by 16% compounded annually over the past decade.

HFC’s current economic book value is $52/share – a 100% upside to the current price.

If we assume that the global economy rebounds and returns to growth starting in 2021, HFC is undervalued.

In this scenario, we assume:

- NOPAT margins fall to 1.3% (low since the 2011 merger, compared to 6% TTM) in 2020 and increase to 5% (all-time average) in 2021 and each year thereafter

- Revenue falls 46% (more than double IBIS World’s estimated Petroleum Refining industry decline of 22.4% in 2020) in 2020

- Revenue grows again in 2021 at 10% (below of 2021 consensus +13%), and at 3.5% each year thereafter which is the average global GDP growth rate since 1961

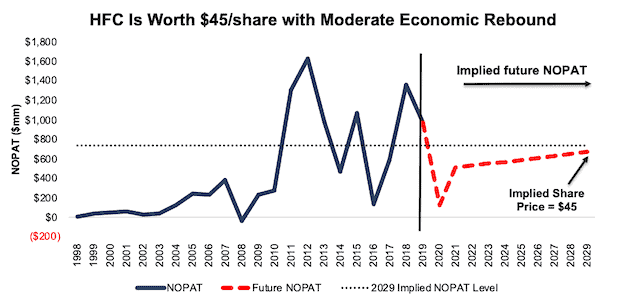

In this scenario, HollyFrontier’s NOPAT falls by 4% compounded annually over the next decade (including an 87% YoY drop in 2020) and the stock is worth $45/share today – a 73% upside to the current price. See the math behind this reverse DCF scenario.

For comparison, HollyFrontier has grown NOPAT by 91% compounded annually over the past three years and 16% compounded annually over the past five years. It’s not often investors get the opportunity to buy a growing company at such a discounted price.

Figure 10 compares the firm’s implied future NOPAT in scenario 2 to its historical NOPAT. This scenario implies that a decade from now, HollyFrontier’s NOPAT will be 31% below NOPAT in 2019 and 30% below NOPAT in 2013. If profits return to these levels in less than 10 years, HFC has even more upside potential.

Figure 10: Implied Profits Assuming Moderate Recovery Leave HFC with Upside

Sources: New Constructs, LLC and company filings

The Importance of Reliable Fundamental Data

In volatile markets, it pays to incorporate accurate fundamentals into investment decision making. Having access to reliable data that better measures profitability and, in turn, valuation, can reveal situations where the market has overly pessimistic expectations of fundamentally strong companies. It’s important that investors make decisions based on the best data available. Our Company Valuation Models incorporate all the data from financial filings to truly assess whether a firm is under- or overvalued, give an accurate representation of the risk/reward of a stock, and help investors make more informed investment decisions (rather than blindly allocating to indexes). For JBSS, UHS, and HFC, as well as the other “See Through the Dip” stocks, the risk/reward looks good.

This article originally published on August 19, 2020.

Disclosure: David Trainer owns SYY, SPG, DHI, JPM, LUV, HCA, and H. David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

Appendix I: Performance of See Through the Dip Stocks

Figure 11 shows the 26 “See Thru the Dip” firms we have featured since April. 20 of the stocks have positive returns and 16 have outperformed the S&P 500 since their publish dates.

Figure 11: See Through the Dip Stocks Vs. S&P 500 – Prices through August 18, 2020

Sources: New Constructs, LLC and company filings.