We published an update on this Long Idea on May 11, 2022. A copy of the associated Earnings Update report is here.

We published an update on this Long Idea on May 5, 2021. A copy of the associated Earnings Update report is here.

Added to our Focus List – Long Model Portfolio on May 2, 2018.

Over the weekend, Barron’s became the latest publication to question the underperformance of value strategies during the current bull market. However, where many commentators have been quick to trumpet value investing’s demise, Barron’s suggested that what we really to need to do is “re-evaluate value.”

Traditional valuation metrics have significant flaws. P/E ratios are based on misleading accounting earnings, and accounting book value ignores significant assets and liabilities hidden off the balance sheet. Colgate-Palmolive (CL: $63/share) looks expensive based on these traditional metrics, but a look at the true cash flows of the business shows otherwise. Its cheap valuation, combined with a long-term track record of growth and profitability, makes CL this week’s Long Idea.

Accounting Earnings Understate CL’s Profitability

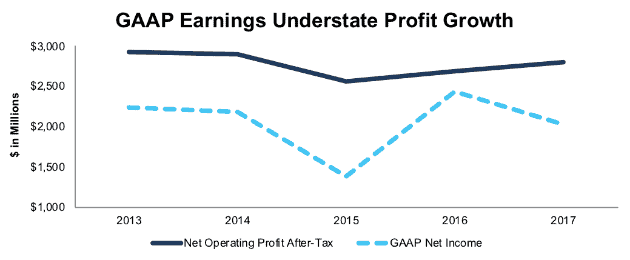

Investors only analyzing reported net income may be led to think that CL’s business is in decline. In reality, CL’s declining GAAP net income in 2017 was the result of accounting loopholes. The true after-tax operating profit (NOPAT) of the business has grown in the mid-single digits each of the past two years.

In fiscal 2017, multiple non-operating expenses lowered CL’s reported earnings. First, the company increased its LIFO reserve by $33 million. Then, on page 79, CL disclosed that it included $164 million of restructuring charges in operating expenses, up $41 million from the year before. These restructuring charges are part of the Global Growth and Efficiency Program that has helped CL cut costs and improve its NOPAT margin from 16.8% in 2012 to 18.1% in 2017. While some companies use “restructuring” as a perpetual item to exclude real costs from non-GAAP earnings, CL’s restructuring program is slated to end in 2019.

Most significantly, on page 100, CL disclosed a $275 million charge due to the impact of tax reform. The new law will significantly lower CL’s cash tax rate going forward, but the company has to pay a one-time repatriation tax on the accumulated earnings of its foreign subsidiaries.

Combined, these three charges have an after-tax value of $409 million, or 20% of GAAP net income. By removing these non-recurring charges, we see that CL’s NOPAT increased 4% year-over-year (YoY) even as GAAP net income declined by 17%.

Figure 1: CL’s NOPAT Grows While Net Income Declines

Sources: New Constructs, LLC and company filings

Over the longer term, CL has grown NOPAT by 3% compounded annually (vs. 2% GAAP net income growth) over the past decade and 5% compounded annually (vs. 3% GAAP net income growth) over the past 15 years. Since 2007, CL has earned a return on invested capital (ROIC) below 20% only twice. Few companies can match CL’s track record of steady profit growth and high ROIC.

Focus on ROIC Creates Shareholder Value

CL has achieved a superior ROIC compared to its peer group by directly incentivizing executives to focus on intelligent capital allocation. ROIC is one of seven metrics that CL uses to determine executive salaries, annual bonuses, and long-term incentives.

This focus on improving ROIC aligns the interests of executives and shareholders and helps ensure prudent stewardship of capital[1]. Shareholders can be confident that CL executives will avoid overpriced acquisitions such as PG’s deal for Gillette. We believe this superior corporate governance is an underrated competitive advantage, which is why we created the Exec Comp Aligned with ROIC Model Portfolio. CL’s strong corporate governance earns it a place in this model portfolio.

CL’s emphasis on ROIC has not come at the expense of growth, either. Over the past decade, the company has grown economic earnings – the true cash flows of the business – from $1.3 billion in 2007 to $2.1 billion in 2017, or 5% compounded annually.

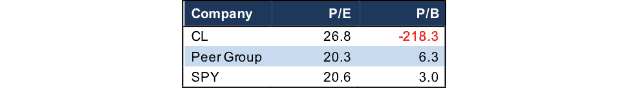

Price to Earnings and Price to Book Don’t Work When Valuing CL

While CL has steadily grown economic earnings, its understated accounting earnings make it look more expensive on a price to earnings (P/E) ratio than both its peer group and the market as a whole. As Figure 2 shows, CL’s current P/E of 26.8 is higher than the median of 20.3 for the peer group listed in its proxy statement and the median of 20.6 for the S&P 500.

Figure 2: CL Looks Overvalued on Traditional Metrics

Sources: New Constructs, LLC and company filings

CL also looks expensive based on price to book (P/B), due to the fact that it has a negative accounting book value. For a consumer goods company like CL, its brand names are its most valuable asset. Since the company has developed the majority of its brands organically, their dollar value is not captured on the balance sheet.

Unlike Colgate Palmolive, Procter & Gamble (PG), one of CL’s main competitors, has acquired some of its most valuable brands, such as Gillette and Clairol. As a result, PG carries these brands on its balance sheet in the form of ~$70 billion (57% of total assets) in goodwill and other intangible assets.

As we’ve written before, CL’s decision not to pursue overpriced acquisitions has led to a higher ROIC and superior long-term stock performance compared to PG. However, the large amount of goodwill on PG’s balance sheet gives it a higher book value and a more attractive looking P/B of 3.3.

As a result, PG is held by value index funds such the Vanguard Value ETF (VTV) while CL isn’t. Investors that use simple screens to find value stocks will miss out on CL because its earnings are artificially depressed and it has avoided overpriced acquisitions. In our opinion, this intelligent capital allocation track record makes CL a much truer value stock than PG.

Superior ROIC Is Correlated with Shareholder Value

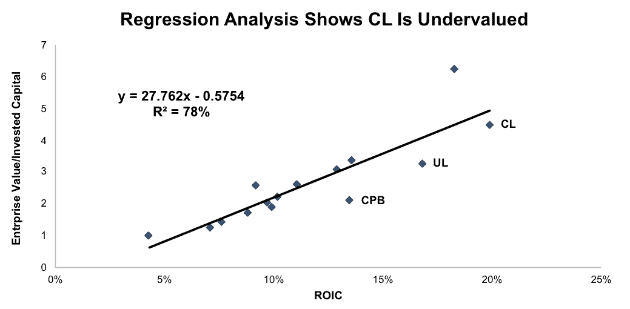

When we cut through the accounting constructs and analyze the real cash flows of the business, we see that CL is actually undervalued compared to its peers.

Numerous case studies show that getting ROIC right is an important part of making smart investments. Ernst & Young recently published a white paper that proves the material superiority of our forensic accounting research and measure of ROIC. The technology that enables this research is featured by Harvard Business School.

Per Figure 3, ROIC explains 78% of the difference in valuations for the 15 stocks in CL’s listed peer group. CL trades at a significant discount to its peers based on the trend line in Figure 3. The only two companies that are cheaper based on this measure are Unilever (UL), which does not expect to see any benefit from tax reform, and Campbell Soup (CPB), which recently completed an overpriced acquisition of Snyder’s Lance.

Figure 3: ROIC Explains 78% of Valuation for CL Peers

Sources: New Constructs, LLC and company filings

CL’s enterprise value per invested capital (which is a cleaner version of price to book and captures the capital put in the business better than accounting metrics) implies that the market expects CL’s ROIC to decline to 18.3%. The last year CL earned an ROIC that low was 2005.

If the stock were to trade at parity with its peers, it would be worth $70/share, or 7% above the current share price. Given CL’s status as the most profitable company in its industry and its long-term track record of profit growth, we would argue it deserves a premium valuation.

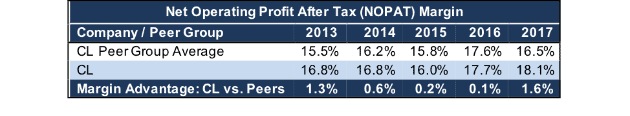

Cost Control and Brand Value Drive Superior Margins

CL has consistently maintained higher margins than its peers, and that advantage increased last year. Per Figure 4, the company’s margin advantage versus its peer group average reached the highest level of the past five years in 2017.

Figure 4: CL’s Superior Margins Over the Past Five Years

Sources: New Constructs, LLC and company filings

CL’s margin expansion in 2017 even as its competitors’ margins declined demonstrates the value of the company’s restructuring program. Management has efficiently cut costs and eliminated inefficiencies over the past few years. We think it is fair to expect to see further gains through the end of the program in 2019.

The company’s persistent margin advantage versus its peers is also a testament to the value and power of its consumer brands. Only one company from CL’s peer group earned a higher NOPAT margin in 2017, and that was The Coca-Cola Company (KO). It takes one of the most famous brands in the world to best CL’s margins.

Valuation Offers Significant Upside Potential

At its current price of ~$63/share, CL has a price to economic book value (PEBV) of 1.1, which implies that the market expects the company to grow NOPAT by no more than 10% for the remainder of its corporate life. This is a pessimistic assumption for a company that has more than doubled NOPAT over the past 15 years.

The market’s low profit growth expectations for CL seem especially pessimistic when one factors in the company’s anticipated benefit from tax reform. CL anticipates that the new tax law will reduce its tax rate to 26-27%, down from the current cash tax rate of 32% in 2017. Even if CL fails to grow pre-tax profit at all in 2018, the tax cut should increase NOPAT by ~9%.

If CL maintains 2017 pre-tax margins of ~27%, pays a cash tax rate of 26%, and grows revenue at an annual rate of 3% over the next 15 years, the stock is worth $88/share today – a 38% upside from the current price. See the math behind this dynamic DCF scenario here.

Investors get the opportunity for significant upside with CL while taking relatively little risk. The company’s business holds up well during uncertain economic times, as it showed when it grew NOPAT and ROIC during 2008-2009. In that market crash, CL dropped by less than 30% and had recovered to its previous high by the end of 2009, while the S&P 500 dropped over 50% and didn’t recover its losses until 2013.

Direct to Consumer Startups Won’t Disrupt CL’s Business

Aside from the misguided notion that CL is expensive, it’s hard to find a credible bear case against the stock. Most investors understand the stability of the business and the trend of slow but steady profit growth that it generates.

One trend that has likely given investors cause for concern is the rise of direct to consumer (DTC) startups that sell everything from toothbrushes to bras through online subscription models. Since 2012, roughly 400 startups have arisen in this category, and they’ve raised a collective $3 billion in venture capital funding.

Some investors believe that these companies have a competitive advantage versus CL because they “cut out the middleman”. There’s no retailer like Walmart (WMT) taking part of the margin, so these companies should be able to serve customers at a lower price.

In reality, the middleman hasn’t been removed, but rather replaced. Instead of retailers taking margin, it’s Google (GOOGL) and Facebook (FB) earning a cut of every transaction. Startups need to advertise heavily online for consumers to find their products, and Google and Facebook are increasingly the only games in town. As a result, Facebook was able to increase its cost per impression 171% in the first half of 2017 alone.

Not only have DTC startups not eliminated the middleman, they’ve actually positioned themselves in a space where the middleman is much more consolidated and powerful. Add in the high cost of shipping directly to consumers, a process that is difficult to scale, and these startups appear to be at a distinct disadvantage to CL and other incumbents.

Daniel Gulati, a partner at Comcast Ventures, said as much when asked about the industry in a recent Inc. article:

“The majority of these brands don’t grow fast enough to warrant venture capital and many don’t work out economically.”

The only thing that has kept these startups in business so far has been the venture capitalists that ignore these disadvantages and have invested billions of dollars. Effectively, VC’s are subsidizing these companies to sell at a loss and be price competitive.

DTC startups may be having a small short-term impact on CL’s margins and market share, but eventually the VC money is going to dry up. When that happens, they won’t have the scale or the resources to compete. These startups don’t pose a significant long-term threat to CL’s cash flows, and their collapse after the VC bubble bursts may provide it with an opportunity for further margin expansion or market share growth.

Growing Dividend and Buybacks Provide 5% Yield

CL has increased its quarterly dividend for 14 consecutive years. Most recently, the company increased its dividend by 5% for 2018, which at current prices, gives it a 2.6% dividend yield. Better yet, CL generates more than enough cash flow to sustain its dividend. From 2013-2017, CL generated a cumulative $12.7 billion (22% of market cap) in free cash flow while paying $7.4 billion in dividends. A long track record of dividend growth combined with healthy free cash flow earns CL a spot on our Dividend Growth Model Portfolio.

In addition to dividends, CL returns capital to shareholders via share repurchases. The company repurchased $1.6 billion, $1.3 billion, and $1.4 billion in fiscal 2015, 2016, and 2017 respectively. CL currently has ~$750 million remaining on its repurchase authorization, but it seems likely that the company will authorize more buybacks in the future given its strong free cash flow. CL’s buyback in 2017 equated to 2.5% of market cap. When combined with the 2.6% dividend yield, the total yield to shareholders tops 5%. This dependable shareholder yield decreases the risk even more for investors.

Value Investors Could Rediscover CL

CL shares have lagged the market significantly in recent years. The stock is down 8% over the past year and roughly flat over the past three years while the market is up 27% since May 2015.

CL stock has struggled in part due to its inability to attract so-called “value” investors. The company’s poor traditional, accounting metrics have kept it off the screens of traditional value investors. As we discussed above, CL has also been left off of the indexes that many prominent value funds track.

Over the next couple years, the combination of tax cuts and the end of the restructuring program should provide a big boost to CL’s accounting earnings to the point where its P/E ratio puts it back on the radar of retail investors and index funds. This new pool of buyers should help drive up the stock price.

We also believe that investors will, as Barron’s put it, “re-evaluate value”. As more people start to understand the limitations of P/E and P/B ratios, they will begin to use more sophisticated metrics that evaluate the real cash flows of the business and not rely on the tired data and metrics that have been the norm for decades. This shift in focus should attract modern value investors to the durable cash flows and high ROIC of CL.

Minimal Insider Trading and Short Interest

Insider activity has been minimal over the past three months with 86 thousand shares bought and 335 thousand shares sold for a net effect of 250 thousand shares sold. These sales represent less than 1% of shares outstanding. There are currently 12 million shares sold short, which equates to 1% of shares outstanding and 4 days to cover. Insiders seem comfortable holding CL, and investors have no interest in betting against this stable and profitable company.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst[2] findings in Colgate-Palmolive’s 2017 10-K:

Income Statement: we made $1 billion of adjustments, with a net effect of removing $777 million in non-operating expense (5% of revenue). We removed $133 million in non-operating income and $910 million in non-operating expenses. You can see all the adjustments made to CL’s income statement here.

Balance Sheet: we made $7.6 billion of adjustments to calculate invested capital with a net increase of $4.7 billion. The most notable adjustment was adding back $3.9 billion in accumulated other comprehensive loss. This adjustment represented 42% of reported net assets. You can see all the adjustments made to CL’s balance sheet here.

Valuation: we made $11.1 billion of adjustments with a net effect of decreasing shareholder value by $9.2 billion. The largest adjustment was $7.4 billion in total debt, which includes $650 million in operating leases. This adjustment represents 13% of CL’s market cap. Despite the decrease in shareholder value, CL remains undervalued.

Attractive Funds That Hold CL

The following funds receive our Attractive-or-better rating and allocate significantly to Colgate-Palmolive:

- YCG Enhanced Fund (YCGEX): 6.8% allocation and Very Attractive rating

- ICON Consumer Staple Fund (ICLEX): 4.5% allocation and Very Attractive rating

- Fiera Capital Global Equity Focused Fund (FCGIX): 4.3% allocation and Very Attractive rating

- Consumer Staples Select Sector SPDR Fund (XLP): 3.5% allocation and Very Attractive rating

- Fidelity MSCI Consumer Staples Index ETF (FSTA): 3.2% allocation and Very Attractive rating

- Vanguard Consumer Staples Index Fund/ETF (VCSAX), (VDC): 3.1% allocation and Very Attractive rating

This article originally published on May 2, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Ernst & Young’s recent white paper “Getting ROIC Right” demonstrates the link between an accurate calculation of ROIC and shareholder value.

[2] Harvard Business School features the powerful impact of our research automation technology in the case study New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

Click here to download a PDF of this report.

Photo Credit: Noelle Otto (Pexels)