Chobani (CHO: $10 billion expected valuation) is expected to go public soon with a rumored valuation of $10 billion, which would earn the stock our Unattractive rating. Fifteen years ago, Chobani changed the yogurt market with more appealing Greek yogurt, but at that valuation, we see an unappealing 79% downside looming.

Key points of this report:

- We expect investors will lose money in Chobani’s IPO at a $10 billion valuation.

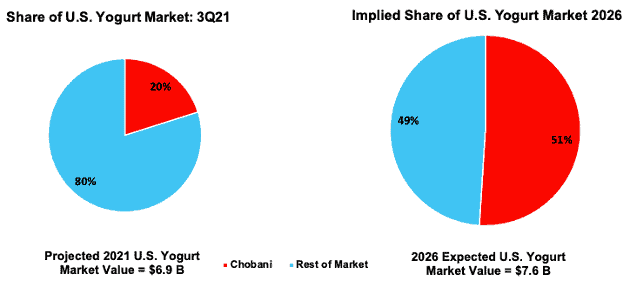

- Justifying such a valuation requires quadrupling revenues by 2026, which would equate to ~51% of the total expected U.S. yogurt market. For reference, Chobani’s market share was 20% in 3Q21.

- International opportunities exist, but Chobani itself says it is not positioned to exploit them anytime soon.

- We think Chobani is worth closer to $2.1 billion given that Greek yogurt is no longer a disruptive high-growth product and the company faces intense competition in new product lines, including from the very retailers that distribute its products.

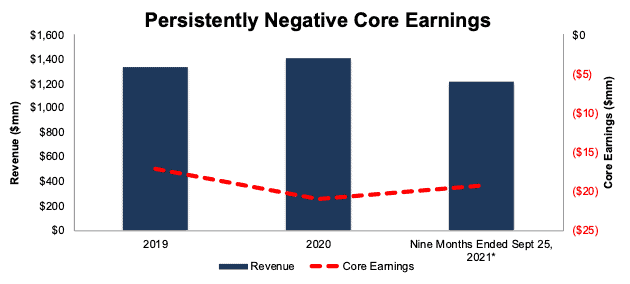

- Despite its leading market share, Chobani’s Core Earnings[1] were negative in 2019 and 2020 and competitive pressures look likely to keep Core Earnings low moving forward.

Our IPO research aims to provide investors with more reliable fundamental research.

Chobani Must Take 51% of the U.S. Yogurt Market To Justify IPO Valuation

In our view, Chobani is grossly overvalued at $10 billion. When we use our reverse discounted cash flow model to quantify the market's expectations for future profit growth required to justify this IPO’s valuation, we think the market is vastly overestimating Chobani’s business potential.

For example, the expected profits require Chobani to take ~51% of the projected U.S. yogurt market in 2026, up from 20% currently. For reference, Yoplait’s 25% in 2011 is the highest market share we’ve seen in the U.S. Anything less than 51% market share in 2026, and Chobani’s stock holds significant downside.

Figure 1: Chobani Market Share vs. Implied Market Share in 2026

Sources: New Constructs, LLC, company filings, and Research And Markets

We provide more details on Chobani’s valuation later in this report, but first we identify the key obstacles that make it unlikely for Chobani to achieve the lofty market share expectations baked into its rumored IPO valuation. We will also look at what Chobani could be worth in more realistic growth scenarios.

Potential Market Share is Limited to Greek Yogurt

It is certainly impressive that Chobani has taken nearly fifty percent of the Greek yogurt segment, which results in owning 20% of the overall U.S. yogurt market. Greek yogurt currently makes up ~52% of the overall U.S. yogurt market.

Realistically, Chobani will never achieve a monopoly on any segment of the market, if for no other reason than competition and anti-trust laws. In that case, winning more customers means either converting non-Greek yogurt eaters or expanding into non-Greek yogurt. Either route is more difficult than simply converting the customers of rivals already in the Greek yogurt segment.

Chobani Is Running Out of Growth Opportunities In Its Main Product

In its S-1, Chobani touts a revenue compounded annual growth rate (CAGR) of 19% from 2010 to 2020, which is impressive. However, growth started from a low base. If we shift the period just a few years forward to 2013 to 2020, Chobani’s revenue CAGR was just 3.5%. With a leading market share and a decade and a half of operations, Chobani is now the mature incumbent, with slow growth rates to match. Going forward, the U.S. yogurt market is projected to grow at just a 2.9% CAGR through 2026.

There’s nothing inherently wrong with a slow-growth, mature, company, except when that company’s IPO valuation implies double-digit growth rates.

International Opportunity is Large, But Chobani Is A Domestic Company

International expansion certainly represents a growth opportunity for Chobani, as, per the S-1, the global yogurt market is currently worth $90.7 billion. However, Chobani admits it is not currently positioned to expand into global markets. From its S-1 (emphasis added), “Incremental international expansion is a large opportunity and can be a meaningful growth driver across our entire product portfolio over the longer term. In the near term, we expect to focus on North America and Australia.”

Indeed, 91% of Chobani’s sales over the nine months ended September 25, 2021 came from North America. For reference, the Australian yogurt market, Chobani’s other focus, is worth an estimated $1.4 billion.

New Products Could Provide Growth Opportunities…

To drive additional growth in its business, Chobani is leveraging its existing brand across similar product categories, each with higher growth rates than the mature yogurt market. For instance, Chobani has launched products in the following markets:

- Plant-based milk – expected 11% CAGR through 2026

- Non-dairy probiotic beverages – expected 8% CAGR through 2026

- Coffee creamer – expected 6% CAGR through 2026

- Ready to drink coffee beverages – expected 5% CAGR through 2026

Higher expected-growth rates from new product lines sound enticing, but they represent just a fraction of Chobani’s business. Yogurt sales made up 86% of Chobani’s revenue in the nine months ended September 25, 2021.

…But New Products Bring New Competition

Chobani was able to supplant incumbent yogurt manufacturers such as Yoplait, owned by General Mills (GIS) and Danone (DANOY), to take a 20% share of the U.S. yogurt market in 3Q21.

However, to justify the expectations baked into its rumored IPO valuation, investors must believe it can do the same across multiple new product categories, each with their own new entrants and incumbents. Below is a non-exhaustive list of the competition in each of Chobani’s product markets.

Yogurt:

- Yoplait

- Dannon

- Oikos

- Stonyfield Farms

- Fage

- Private label/grocery store’s own brand

Milk and Milk Alternatives

- Oatly (OTLY)

- Silk (owned by Danone)

- Almond Breeze

- Horizon (owned by Danone)

- Planet Oat

- So Delicious (owned by Danone)

- Ripple

- Private label/grocery store’s own brand

Coffee Creamer

- Coffee-mate (owned by Nestle)

- International Delight (owned by Danone)

- Starbucks (SBUX)

- So Delicious

- Silk

- Private label/grocery store’s own brand

Ready to Drink Coffee Beverages

- La Colombe

- Peets

- Starbucks

- Monster Beverage (MNST) coffee

- Stok (owned by Danone)

- Califia Farms

- Local coffee with local distribution

Distribution Partners Can Quickly Become the Most Threatening Competitors

Chobani notes in its S-1 that it currently sells its products through ~95,000 retail locations in the United States, including large grocery stores such as Walmart (WMT), Whole Foods (AMZN), Target (TGT), and Kroger (KR). However, these businesses increasingly represent Chobani’s biggest competition.

As we noted in our Danger Zone report on Beyond Meat (BYND), retailers have a competitive advantage over stand-alone consumer food providers. Retailers generate huge volumes of data on consumer preferences, giving them free access on which products for which they should introduce private label and/or store brand versions. For instance, both Kroger and Walmart already sell their own brand of Greek yogurt, and Kroger sells oat milk through its Simple Truth brand.

As retailers from Kroger to Sprouts Farmers Market (SFM) lean heavily into private label to improve margins, Chobani’s primary distribution partners will continue to become its competitors, and those competitors also happen to control shelf space in the retail locations. In other words, the competitors can cut Chobani’s shelf space to make room for selling their own products.

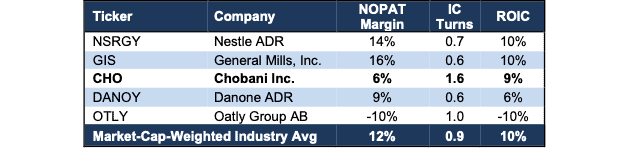

Leading Share Doesn’t Equal Leading Profitability

Despite its leading market share of the U.S. yogurt market, Chobani does not exhibit any pricing or cost advantages over its larger competitors. Of its closest peers, Nestle (NSRGY), General Mills, Danone, and Oatly (OTLY), Chobani’s net operating profit after-tax (NOPAT) margin only ranks higher than Oatly and is half the market-cap weighted average of the 51 Food Processing firms under coverage. The firm does have better balance sheet efficiency, as illustrated by its leading invested capital turns, but it is not enough to offset lower margins when it comes to return on invested capital (ROIC).

Chobani’s ROIC ranks below Nestle, General Mills, and the market-cap weighted average of the overall industry. See Figure 2.

Not surprisingly, the company with the highest NOPAT margin in Figure 2 is General Mills, which is a multi-national conglomerate of different consumer food brands, not just one brand limited to a relatively small end market. General Mills’ large scale drives greater efficiencies, increased leverage over distribution outlets, and a diversification that Chobani lacks.

Figure 2: Chobani’s Profitability Vs. Competitors

Sources: New Constructs, LLC and company filings

Competition Further Limits Margin Improvement

Companies across the globe are dealing with the impacts of higher raw material, labor, and logistics costs. Some companies, such as Sysco (SYY) or Sprouts Famers Market are able to pass these higher costs onto consumers and maintain their margins.

Chobani possesses no such advantage because of the ultra-competitive nature of the consumer foods industry. Even the company admits that if it raises prices to offset rising costs, consumers will simply purchase the next cheapest substitute. Chobani specifically notes in its S-1, “we are generally unable to pass through increases in raw material costs to consumers due to pricing pressure.”

Expanding margins while growing market share looks unlikely given competition from established firms looking to take back market share and disruptive startups entering the market.

Profits Are Likely to Remain Minimal or Negative

Chobani, despite its mature business (compared to other recent IPOs) and leading market share, is not profitable on a GAAP or Core Earnings basis in 2019, 2020, or the nine months ended September 25, 2021.

Chobani’s material costs, and overall cost of sales weigh heavily on the firm’s results. In 2018, cost of sales represented 74% of revenue and selling, general and administrative costs were 21% of revenue.

The company reports an operating income margin of 4.6% in 2018. However, in the nine-months ended September 25, 2021, cost of sales rose to 79% of revenue, and its operating income margin fell to just 3.7%.

Chobani’s Core Earnings fell from -$17 million in 2019 to -$21 million in 2020. Our estimate for Chobani’s Core Earnings for nine months ended September 25, 2021 is -$19 million. As the firm pursues its top-line growth strategy of expanding into new product lines, heavy competition with larger scale is likely to keep the company from achieving meaningfully positive profits in the near term.

Figure 3: Chobani Revenue & Core Earnings: 2019 through First Nine Months 2021

Sources: New Constructs, LLC and company filings

* We estimate Core Earnings over the nine months ended September 25, 2021 by assuming Core Earnings improved at the same rate as reported operating income over 2020.

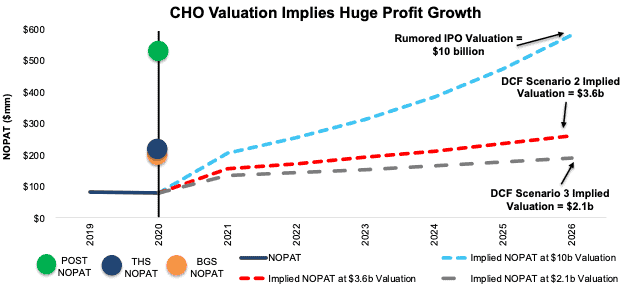

Chobani Is Priced to Take 51% the Expected 2026 U.S. Yogurt Market

Below we provide more details, including clear, mathematical evidence that Chobani’s expected $10 billion valuation is too high and offers unattractive risk/reward.

To justify a $10 billion valuation, Chobani must:

- immediately improve its NOPAT margin to 12% (equal to the market-cap weighted peer group average and 2x Chobani’s margin, per Figure 2) and

- grow revenue by 23% compounded annually through 2026, which is nearly 8x the expected yogurt industry growth rate through 2026, and more than 2x the expected growth rate of plant-based milk market through 2026 (Chobani’s fastest growing product market).

In this scenario, Chobani would generate $4.9 billion in revenue, which is on par with Monster Beverage’s TTM revenue and nearly 4x Chobani’s own 2020 revenue. In this scenario, Chobani’s yogurt revenue in 2026[2] would equate to ~51% of the projected U.S. yogurt market in the same year, up from 20% in 3Q21. Again, for reference, Yoplait’s 25% in 2011 is the highest market share we’ve seen in the U.S.

In this history of the world, the number of companies that grow revenue by 20%+ compounded annually for such a long period is unbelievably rare, which make the expectations baked into Chobani’s expected IPO valuation look even more unrealistic. Even during Chobani’s chosen period of 2010-2020, it grew revenue by “only“ 19% compounded annually.

DCF Scenario 2: Entire Business Grows at Rate of Fastest Growing Product Market

We review an additional DCF scenario to highlight the downside risk should Chobani’s entire business grow as fast as the projected growth of the plant-based milk market, which is anticipated to be the fastest growing (through 2026) market Chobani operates in.

If we assume Chobani’s:

- NOPAT margin immediately improves to 10% (above Danone’s margin of 9%), and

- revenue grows by 11% (plant-based milk projected CAGR through 2026) compounded annually through 2026, then

Chobani is worth $3.6 billion – a 64% downside to the rumored IPO valuation. See the math behind this reverse DCF scenario. In this scenario, Chobani’s sales in 2026 would still represent 34% of the projected U.S. yogurt sales in 2026.

Should Chobani struggle to improve margins at such a rapid pace or grow revenue more in line with some of its slower growing product markets, the stock could be worth even less.

DCF Scenario 3: Chobani Matches Danone’s Margins

We review an additional DCF scenario to highlight the downside risk should Chobani’s margins match Danone and revenue grow more in line with its other product markets.

If we assume Chobani’s:

- NOPAT margin immediately improves to 9%, and

- revenue grows by 7% compounded annually (2x Chobani’s revenue CAGR from 2013-2020 and more in-line with the expected CAGRs of the coffee creamer, coffee drink, and probiotic drink markets) through 2026, then

Chobani is worth just $2.1 billion – a 79% downside to the rumored IPO valuation. See the math behind this reverse DCF scenario.

Figure 4 compares the firm’s implied future NOPAT in these three scenarios to its historical NOPAT. For context, we also include the 2020 NOPAT of consumer foods firms Post Holdings (POST), Treehouse Foods (THS), and B&G Foods (BGS). We’re unable to include Chobani’s closest competitors (those listed in Figure 2) due to each firm’s respective NOPAT literally being off the chart.

Figure 4: Rumored IPO Valuation Is Too High

Sources: New Constructs, LLC and company filings

Each of the above scenarios also assume Chobani grows revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is highly unlikely but allows us to create best-case scenarios that demonstrate the extraordinarily high expectations embedded in the current valuation.

Limited Stupid Money Acquisition Risk

On its own, Chobani is unlikely to generate the profits needed to justify an expected $10 billion valuation but there is always the potential for the greater fool to acquire the company. However, Chobani’s election to be treated as a public benefit corporation makes a buyout less likely. As a public benefit corporation, Chobani is required to balance the interest of stockholders and all stakeholders, which may result “in actions that do not maximize stockholder value.”

Chobani has multiple anti-takeover provisions in place that would make acquisition more costly/difficult if the founder ceases to hold at least fifty percent of the voting power in the company. Provisions include establishing a classified board of directors (also known as staggered board, where members serve staggered 3-year terms so only a portion of the Board can be replaced at one time), eliminating the ability of stockholders to call special meetings, and prohibiting stockholders from being able to fill vacancies on the Board of Directors.

Look Out for These Red Flags

With a lofty valuation that implies significant improvement in both revenue and profits, investors should be aware that Chobani’s S-1 also includes these other red flags.

Public Shareholders Have No Say: A downside of investing in Chobani’s IPO, and certain other recent IPOs, is the fact that the shares provide little to no say over corporate governance. Investors in the IPO will get Class A shares, with just one vote per share. Chobani’s founder and CEO, Hamdi Ulukaya will indirectly own 100% of the Class B shares, with ten votes per share.

While specific voting percentages have not been disclosed yet, Chobani does note in its S-1 that “Hamdi Ulukaya will be able to control matters requiring stockholder approval…This concentration of ownership makes it unlikely that any holder or group of holdings of our Class A common stock will be able to effect the way we are managed or the direction of our business.”

In other words, Chobani is taking investors’ capital through its IPO, while giving effectively no control of corporate decision making and governance. Ulukaya’s holding control of the company should come at a price with the Class A shares priced at a discount to their intrinsic value.

Non-GAAP EBITDA Looks Better than Reality: Adjusted EBITDA gives management significant leeway in how it presents results and Chobani’s management makes full use of it. For instance, Chobani’s Adjusted EBITDA in 2020 removes $16.3 million (1% of revenue) in costs related to launching new products and $4.4 million in stock compensation costs. After removing all items, Chobani reports adjusted EBITDA of $191 million in 2020. Meanwhile, economic earnings, the true cash flows of the business, are much lower at $34 million.

While Chobani’s adjusted EBITDA follows the same trend as economic earnings from 2019 to 2020, investors need to be aware that there is always a risk that Adjusted EBITDA could be used to manipulate earnings going forward.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

Fact: we provide superior fundamental data and earnings models – unrivaled in the world.

Proof: Core Earnings: New Data and Evidence, forthcoming in The Journal of Financial Economics.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Chobani’s S-1:

Income Statement: we made $137 million of adjustments, with a net effect of removing $137 million in non-operating expenses (10% of revenue). You can see all the adjustments made to Chobani’s income statement here.

Balance Sheet: we made $120 million of adjustments to calculate invested capital, with a net effecting of increasing invested capital by $72 million. The most notable adjustment was $21 million in other comprehensive income. This adjustment represented 3% of reported net assets. You can see all the adjustments made to Chobani’s balance sheet here.

Valuation: we made $1.5 billion of adjustments to shareholder value, with a net effect of decreasing shareholder value by $1.5 billion. The largest adjustment to shareholder value was $1.5 billion in total debt. This adjustment represents 15% of the expected IPO valuation. See all adjustments to Chobani’s valuation here.

This article originally published on December 17, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Core Earnings enable investors to overcome the flaws in legacy fundamental data and research, as proven in Core Earnings: New Data & Evidence, written by professors at Harvard Business School (HBS) & MIT Sloan for The Journal of Financial Economics.

[2] To calculate implied market share, we assume Chobani’s Yogurt sales make up 80% of revenue, which is down from 86% of revenue in the nine months ended September 25, 2021.