We closed this position on April 1, 2020. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life and Marketwatch.com

Many of our recent Danger Zone reports have focused on similar themes. This is not by design, but when you see lots of companies with serious issues and overvalued stocks, you call a spade a spade. Those who follow our Danger Zone picks know that our performance speaks for itself.

This week’s Danger Zone focuses on another food products business, similar to recent Danger Zone stocks WhiteWave (WWAV) and Snyder’s-Lance (LNCE). Large destruction of shareholder value, skyrocketing debt levels, and insufficient returns on invested capital (ROIC) play a part in Post Holdings (POST: $67/share) landing in the Danger Zone this week.

Post’s Revenue Growth Creates No Value

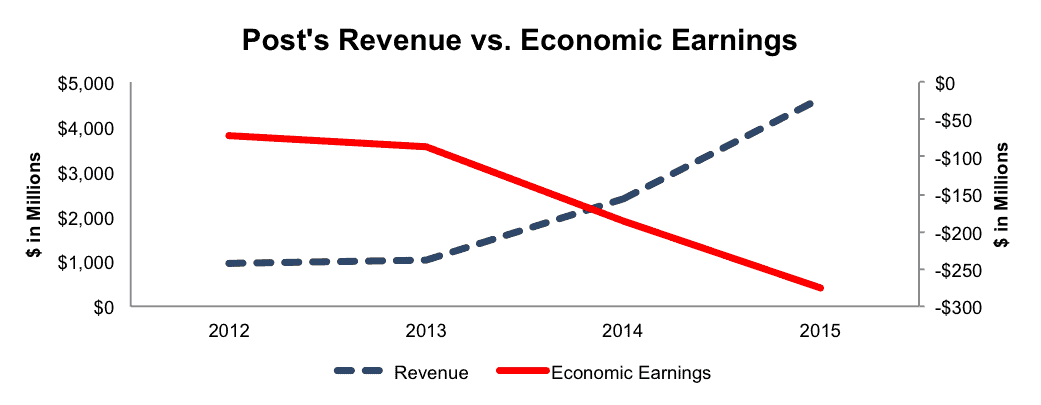

Since the 2012 spin-off from Ralcorp, Post has exhibited strong revenue growth to the tune of 69% compounded annually. Unfortunately, this revenue growth has come at the expense of economic earnings, the true cash flows available to equity investors. Post’s economic earnings have declined from -$72 million in 2012 to -$276 million in 2015.

Figure 1: The Disconnect Between Revenue & Economic Earnings

Sources: New Constructs, LLC and company filings

Post’s rapid revenue growth has come via a series of acquisitions that boosted its reach beyond cereal to egg, dairy, protein shakes/bars, and snack nut products. These acquisitions also boosted the firm’s balance sheet. Profits, however, have seen a decline, not a boost.

From 2012-2015, Post’s invested capital has grown from $2.6 billion to $8.4 billion, or 47% compounded annually. Debt has grown from $1 billion to $4.6 billion, or 67% compounded annually over this same time. All the acquisition activity has done nothing to improve return on invested capital (ROIC), a bottom quintile 4% ROIC, which is below the company’s weighted average cost of capital (WACC) of 6.7%. It has hurt NOPAT margins, which have fallen from 10% in 2012 to 5% in 2015.

What happens when you acquire a bunch of companies but do not increase profits? You bleed -$5.3 billion (126% of market value) in free cash flow (from 2012-2015).

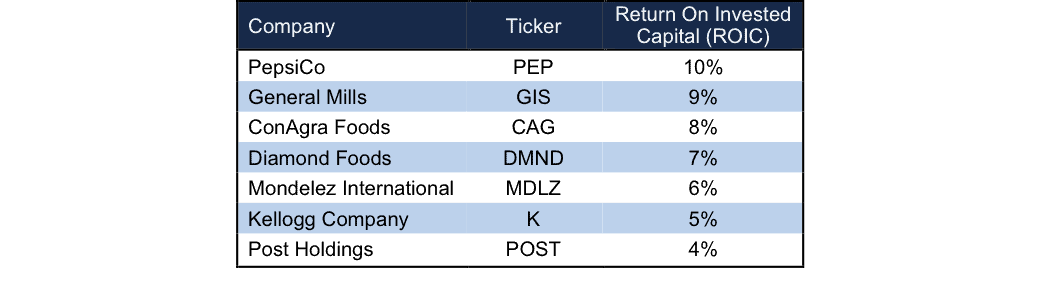

Post Lacks Competitor’s Profitability

Post’s 4% ROIC should concern investors. Unlike WhiteWave, which operates in the smaller, organic/natural food market, Post operates in the larger, general food and snack market. We think competition is more intense in the general snack and food market, which makes it harder for Post to compete on price. Out of the 120 Consumer Staples companies under coverage, only 19 (16% of sector) have a lower ROIC. With an already low ROIC, we find it hard to see how Post can improve margins and begin creating true shareholder value.

Figure 2: Post’s Lagging Profitability Creates Issues

Sources: New Constructs, LLC and company filings

Bull Case Implies “More of the Same”

Bulls of POST will point to the stock price, which is up 143% since 2012, as proof that the current strategy is working. Looking forward, these bulls would argue that management can simply continue executing the same plan and deliver the same results. Unfortunately, more of the same would imply significant shareholder dilution, as shares outstanding have doubled since 2012 while debt obligations have more than quadrupled to fund -$5.3 billion in free cash flow over the past few years. If Post is operating such a successful business model, why would they require such significant outside capital year in and year out?

Even if Post were to change strategy and start creating true shareholder value, we do not see any upside in the stock because such a turnaround is already baked into the stock.

POST Is Overvalued, Even With Acquisition Premium

Prior to running Post, CEO William Stiritz executed the sale of RalCorp (which Post was spun out of) to ConAgra in 2012. Could management be hoping for a similar result with Post Holdings? If so, its actions are only making the company more unattractive to a potential buyer. In fact, Post has large hidden liabilities that make it more expensive than the accounting numbers suggest.

- $800 million in net deferred tax liabilities (19% of market cap)

- $126 million in underfunded pensions (3% of market cap)

- $100 million in outstanding employee stock options ( 2% of market cap)

Looking past these hidden liabilities, Post doesn’t represent an attractive takeover target. For the sake of argument, let’s assume ConAgra wishes to acquire Post. If we assume that POST immediately achieves ConAgra’s margins and ROIC, Post would still have to grow NOPAT by 24% compounded annually for five years to justify purchase at its current stock price. While this scenario may not seem impossible, a more realistic price ConAgra should pay is $40/share (40% downside from current share price), which is the value of Post’s business based on the value of the firm if it achieves ConAgra’s 10% NOPAT margin in year one of the acquisition.

On its own, if Post can grow NOPAT by 15% compounded annually for the next decade, the stock is worth only $13/share today – an 80% downside.

Write-Downs Could Bring POST Down

Throughout its acquisition spree, Post has been accumulating goodwill and other intangibles. In 2015, goodwill and other intangibles made up 65% of total assets. In our prior research, we have found that bigger acquisitions directly lead to impairments. Why would this goodwill and potential impairment matter to investors? Big acquisitions artificially inflate book value and accounting earnings, which leads to a disconnect between market valuations and economic book value. During a bullish market, this artificial value can be upheld, but when markets turn bearish (much like they have in 2016) we see that goodwill wiped off the books in a dramatic manner and a reconciliation between cash flows and valuation.

While we can’t predict exactly when Post shares are brought back down to reality, we can look to previous Danger Zone stocks WhiteWave and Lance as prime examples of how damaging this decline can be. Since our reports, WhiteWave is down 11% and Lance is down 18% compared to a decline of 5% and 7% of the S&P respectively since these articles were published.

Insider Sales and Short Interest Remain Low

Over the past 12 months 857,000 shares have been purchased and 29,000 shares have been sold for a net effect of 828,000 insider shares purchased. These purchases represent 1% of shares outstanding. Additionally, there are 5.9 million shares sold short, or 9% of shares outstanding.

Executive Compensation Not Aligned With Shareholders’ Interests

Post’s executive compensation plan fails to focus on any metrics that drive shareholder value. Annual executive bonuses are tied to the performance metrics adjusted EBITDA and adjusted free cash flow. Adjusted EBITDA removes a litany of real business expenses including stock based compensation, restructuring and plant closure costs, integration costs, and acquisition costs. Similarly, adjusted free cash flow is calculated by removing capital expenditures related to acquisitions from adjusted EBITDA. These non-GAAP metrics, and the many items removed from them allow management extreme leeway to meet their intended targets and ensure they receive their bonuses.

This isn’t the first time we’ve seen Danger Zone companies align management’s interest with non-GAAP metrics. In other instances, the results of this misalignment aren’t pretty. Demandware is down 59%, Groupon is down 52%, and Marketo is down 50% since being placed in the Danger Zone. Each of these firms chose to strive for non-GAAP goals while ignoring true value creation. Investors would be better suited if executives used ROIC to determine executive pay because ROIC is directly correlated with creating shareholder value.

Impact of Footnotes Adjustments and Forensic Accounting

In order to derive the true recurring cash flows, an accurate invested capital, and a real shareholder value, we made the following adjustments to Post’s 2015 10-K:

Income Statement: we made $665 million of adjustments with a net effect of removing $373 million in non-operating expenses (8% of revenue). We removed $519 million related to non-operating expenses, and $146 million related to non-operating income.

Balance Sheet: we made $2.1 billion of adjustments to calculate invested capital with a net decrease of $691 million. The most notable adjustment was $713 million (8% of net assets) related to midyear acquisitions.

Valuation: we made $6.2 billion of shareholder value adjustments with a net decrease of $5 billion. The largest adjustment was the removal of $4.6 billion (109% of market cap) in total debt, which includes $52 million in off balance sheet operating leases.

Dangerous Funds That Hold POST

The following fund receives our Dangerous rating and allocates significantly to Post Holdings.

- Gabelli Focus Five Fund (GWSIX) – 2.8% allocation and Very Dangerous rating.

- Diamond Hill Small-Mid Cap Fund (DHMAX) – 2.5% allocation and Dangerous rating.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.

Click here to download a PDF of this report.

[/opmIf]Photo Credit: Ricardo Velasquez

2 replies to "Danger Zone: Post Holdings (POST)"

Does this include the latest data from it’s latest earnings report given I believe on Feb 11th?

POST’s 4% ROIC does include the data from the most recent earnings report.