We closed this position on November 12, 2021. A copy of the associated Position Update report is here.

Check out this week’s Danger Zone interview with Chuck Jaffe of Money Life.

We first rang alarm bells on this company when it went public in April 2015. Since then, profits have declined and the market has grown more competitive, yet the stock has tripled.

Now, the firm’s lack of resources (relative to competitors) and low profitability make the expectations baked into the stock price look overly optimistic. These issues, and more, make GoDaddy Inc. (GDDY: $61/share) this week’s Danger Zone pick.

Revenue Growth and Accounting Earnings Mislead Investors

We leverage our Robo-Analyst technology[1] to analyze the footnotes and MD&A in company filings to get an accurate look at a company’s true profitability. Through this work, we find that GoDaddy’s GAAP net income was artificially increased in 2017 due to hidden (and non-hidden) non-operating income.

We made 10 adjustments to GoDaddy’s 2017 income statement, with a total value of $279 million. One of the larger adjustments was the removal of $32 million (23% of GAAP net income) in non-operating income related to the gain on sale of PlusServer. We also removed $123 million (90% of GAAP net income) in tax receivable agreement liability adjustments included on the income statement.

After taking into account all adjustments, we removed $86 million in non-operating income from GAAP net income. These adjustments revealed that despite GAAP net income increasing from -$17 million in 2016 to $136 million in 2017, after-tax profit (NOPAT) fell from $54 million to $50 million over the same time.

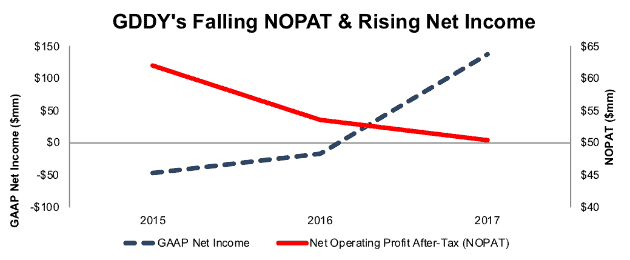

This disconnect in GAAP net income and the true recurring profits of the business is not new either. Since 2015, GDDY’s net income has grown from -$47 million to $136 million while NOPAT has fallen 10% compounded annually, per Figure 1.

Figure 1: GDDY’s Misleading GAAP Net Income

Sources: New Constructs, LLC and company filings

The decline in NOPAT stems from NOPAT margins falling from 4% in 2015 to 2% in 2017. At the same time, average invested capital turns, a measure of balance sheet efficiency, have fallen slightly from 0.70 in 2015 to 0.68 in 2017. Falling margins and inefficient capital use have dropped GDDY’s return on invested capital (ROIC) down from 3% in 2015 to 2% in 2017.

Lack of Comparability in Shifting Non-GAAP Metrics

We’ve long warned investors about companies using non-GAAP metrics to obscure actual profits. GoDaddy’s use of non-GAAP takes this misleading practice one step further and limits comparability to previous years by changing the non-GAAP metric on which they tell investors to focus. At the end of 2016, GoDaddy stopped reporting adjusted EBITDA, which removed significant expenses, such as equity-based compensation, from its calculation. In its place, the firm began reporting “unlevered free cash flow”, which is supposed to “evaluate the business prior to the impact of its capital structure and after-tax distributions”. Unlevered free cash flow adds back cash paid for interest and cash paid for acquisition-related costs.

Both metrics significantly overstate the profitability of the business. Adjusted EBITDA removes real operating expenses and completely ignores the balance sheet, while “unlevered free cash flow” doesn’t take into account the costs of acquisitions, like GoDaddy’s $1.8 billion acquisition of HEG in 2017. Switching between the metrics exaggerates their flaws by making it difficult to compare profitability between periods.

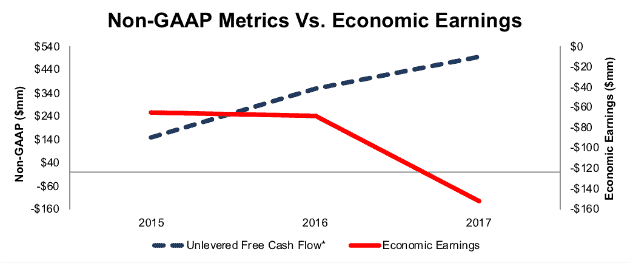

In either case, Figure 2 shows that non-GAAP metrics provide a misleading picture of GDDY’s profitability. From 2015-2016, adjusted EBITDA increased from $147 million to $263 million. When calculating adjusted EBITDA, GoDaddy removed $40 million (>100% of net income) and $57 million (>100% of net income) in equity-based compensation expense in 2015 and 2016 respectively. Meanwhile, economic earnings, the true cash flows of the business, fell from -$65 million to -$68 million.

Figure 2: GDDY’s Non-GAAP Metrics Paint False Picture of Firm

* Prior to 2016, GDDY reported Adjusted EBITDA, which was replaced by Unlevered Free Cash Flow in 2016

Sources: New Constructs, LLC and company filings

From 2016-2017, unlevered free cash flow rose from $357 million to $496 million, while free cash flow (see calculation here) fell from $161 million to -$1.5 billion and economic earnings fell from -$68 million to -$152 million.

Compensation Plan Rewards Execs Despite Shareholder Value Destruction

GoDaddy’s executive compensation misaligns executives’ interests with shareholders’ interests. The misalignment helps drive the profit decline shown in Figures 1 and 2.

GoDaddy’s executives earn annual cash bonuses based on the achievement of corporate and individual performance goals. The corporate performance goals include bookings, adjusted EBITDA, unlevered free cash flow, and total customers. Equity awards are given in either time-based options or performance-based stock units, which are also tied to bookings and adjusted EBITDA.

As noted above, these non-GAAP metrics do little to measure the true profitability of the firm. Instead, they include numerous adjustments that allow executives to earn bonus awards while destroying shareholder value. We’ve demonstrated through numerous case studies that ROIC, not non-GAAP net income or similar metrics, is the primary driver of shareholder value creation. A recent white paper published by Ernst & Young also validates the importance of ROIC (see here: Getting ROIC Right) and the superiority of our data analytics. Without major changes to this compensation plan (e.g. emphasizing ROIC), investors should expect further value destruction.

GoDaddy’s Brand Name Can’t Outlast Superior Competition

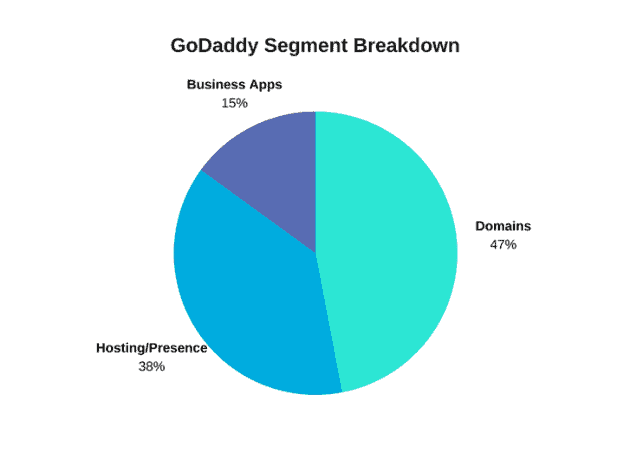

GoDaddy may be best known for its flashy Super Bowl ads from years ago, but the company operates in three main segments: domains, hosting & presence, and business applications. See Figure 3.

Figure 3: Domains Still Make Up Largest Portion of Revenue

Sources: New Constructs, LLC and company filings

GoDaddy may have had an advantage at one point due to its superior brand recognition, but its advantage has disappeared. Customers today are just as familiar, if not more so, with many of its competitors.

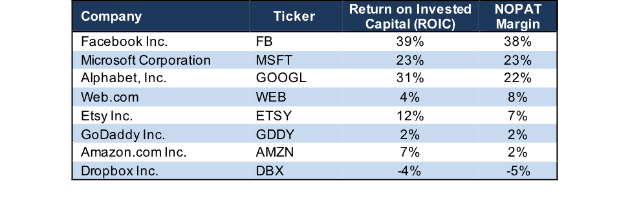

Per Figure 4, GoDaddy’s margins and ROIC, rank well below its largest competition (as noted in its 10-K) and only outrank previous Danger Zone Pick Dropbox (DBX). More alarming, GoDaddy’s margins have declined despite diversifying its business away from the commoditized domain registration business.

Figure 4: GoDaddy’s NOPAT Margin Ranks Near the Bottom

Sources: New Constructs, LLC and company filings

GoDaddy Losing Ground in Commoditized Domain Registration

The domains segment allows customers to register and purchase domain names. This segment is largely commoditized, as the price registrars pay for domains is set by VeriSign (VRSN), which holds a contract to distribute domain names from the Internet Corporation for Assigned Names and Numbers (ICANN). This contract runs through 2024 and sets a standard price on the cost of domains. With set costs, this segment provides little room for margin expansion despite being GoDaddy’s largest revenue source.

Domain registration competitors include Web.com (WEB), namecheap.com, DreamHost, United Internet, Donuts, Google (GOOGL) – which recently entered the domain registration market – and more.

Even worse, what was once GoDaddy’s namesake business is losing ground. From 2014-2016, GoDaddy’s market share in domain registration fell from 21% to 19%. It jumped back to 22% in 2017, but largely due to GoDaddy’s acquisition of Host Europe Group, which added 1.6 million customers. With dwindling capital (more on this below) GoDaddy cannot rely on acquisitions to boost market share.

Hosting and Site Creation Are Not Strengths Either

The hosting & presence segment offers website hosting services as well as tools to build websites and online stores. GoDaddy provides these services in an effort to diversify its revenue sources while also providing additional value to its customers.

Website hosting and creation competitors include Amazon Web Services (AMZN), WordPress, Shopify (SHOP), Squarespace, Weebly, Wix (WIX), and more. Unfortunately for GoDaddy, its site creation lags many of its competitors, in both market share and function. According to Datanyze, which calculates market share for web technologies, Wix is the leader in website building with a 23% market share. Squarespace comes in second with 17%, while Weebly has 15% and GoDaddy has just 9% of the market.

Additionally, numerous reviews note that GoDaddy’s site builder, which does not offer a free version, lacks standard features often provided by free competitors. Product integration (domain and site building) can be a positive add-on, but only if you’re offering clients the best available services and tools.

Business Applications Market Dominated by Tech Giants

Lastly, the business applications segment includes email accounts, email marketing tools, and IP-based telephone services.

Business application competitors include tech giants such as Microsoft (MSFT) and Google (via Gmail), and Dropbox (DBX). Social platforms and third-party e-commerce sites such as Facebook (FB) or Etsy (ETSY) also present competition as they provide sales and marketing capabilities outside of creating a traditional website.

We don’t think it is likely that this business segment will generate much, if any, profit growth given the stiff competition and relatively weak offerings of GoDaddy.

Bull Case Ignores A Commoditized Product, Years with No Profits, Rising Costs, & Less Flexibility

Despite being founded in 1997, GoDaddy’s first reported accounting profits occurred in 2017. As we noted earlier, this reported profit was artificially achieved with significant unusual income. Because of the lack of real profits, investors have chosen to focus on revenue growth and customer growth, while ignoring real issues in the business. As the industry slows, rising costs and lack of resources in a highly competitive (and commoditized) industry threaten any bull case.

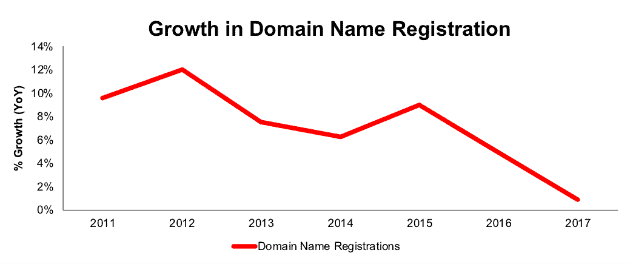

According to Verisign’s Domain Name Industry Brief reports, the growth in domain name registrations is slowing significantly. Per Figure 5, top level domain name registrations grew 1% year-over-year in 2017, down from 10% year-over-year in 2011.

Figure 5: Domain Name Registration Growth is Slowing

Sources: New Constructs, LLC and company filings

Despite the slowing growth of domain registrations, GoDaddy achieved record revenues in 2017 and grew its customer base by 18% (11% came from an acquisition). However, its operating expenses grew even faster. Year-over-year, general & administrative, technology & development, and customer care costs grew 28%, 24%, and 21%, respectively. Cost of revenues and marketing and advertising grew 18% and 11% YoY as well. For reference, revenue grew 21% YoY.

Making matters worse, some of these costs may not be reduced, unless GDDY sacrifices key functions. For instance, customer care expenses represent the cost to advise and service customers. As GoDaddy strives to increase customer count, it must also increase customer care. For a firm already plagued with numerous complaints regarding its customer care, this cost structure could prove a challenge to sustaining customer growth and achieving profitability.

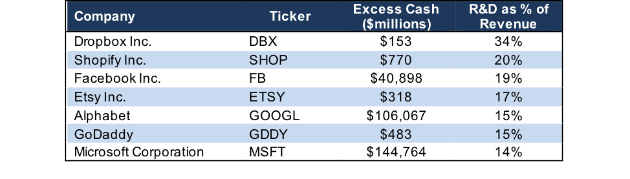

Beyond cost concerns, GoDaddy lacks the capital and the operational flexibility to grow at rates required by its valuation. GoDaddy’s excess cash is dwarfed by its more profitable competitors.

Figure 6: GoDaddy’s Spending and Capital Resources Lag Competition

Sources: New Constructs, LLC and company filings

In their last fiscal years, Alphabet, Microsoft, and Facebook spent over $37 billion in research & development expenses combined, or nearly five times GDDY’s market cap. Dropbox, Shopify, and Etsy each allocated more capital to research & development as a percent of revenue than GoDaddy as well, per Figure 6. GDDY is fighting stronger competition that is investing more into their businesses.

Further limiting bull arguments, GDDY needs to keep investing heavily to maintain its revenue and customer growth. The majority of its customer growth in 2017 was attributable to acquisitions, and its organic customer growth was just 7%. However, without the resources of its larger competitors, GoDaddy cannot adequately develop new technologies to meet consumer needs and risks losing business to other offerings.

Even if you believe that GDDY can reverse years of poor operating results (in a more competitive market than when it started) and maintain high revenue growth, such optimism is already reflected in the stock price. GDDY’s current valuation implies that it will immediately improve margins and significantly grow profits for years to come, as shown below.

GDDY is Priced for Near Perfection

Despite the fundamental deterioration noted above, GDDY is up 67% while the S&P is up just 12% over the past year. This rapid price appreciation has left GDDY significantly overvalued, both by traditional metrics and when analyzing the expectations baked into the stock price. GDDY’s P/E ratio of 77.6 is well above the Technology sector average of 37.8 and the S&P 500 average of 24. When we analyze the cash flow expectations baked into the stock price, we also find that GDDY faces significant downside risk.

To justify its current price of $61/share, GDDY must immediately improve NOPAT margins to 6% (slightly below competitor Web.com and well above GDDY’s 2% in 2017) and grow NOPAT by 25% compounded annually for the next 13 years. See the math behind this dynamic DCF scenario here.

In this scenario, GDDY would be generating over $15.4 billion in revenue, which, at current per user averages, implies the firm would have over 110 million customers. For reference, GDDY had 17 million customers in 2017. To grow its user base to such levels, GoDaddy must convince the next generation of consumers that its services are better than the competition, not just milk the customer based acquired when it had first-mover advantage. New customers may be harder to acquire given how much more sophisticated and discerning they are about the internet and website. It will take more than some flashy Super Bowl commercials to get their business.

Even in a highly optimistic scenario, GDDY holds significant downside. If we assume GDDY achieves an 8% NOPAT margin (equal to competitor Web.com) and grows NOPAT by 23% compounded annually for the next decade, the stock is worth only $25/share today – a 59% downside. See the math behind this dynamic DCF scenario here.

Each of these scenarios also assumes GDDY is able to grow revenue, NOPAT and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, GDDY’s invested capital has grown on average $424 million (19% of 2017 revenue) over the past three years.

Is GDDY Worth Acquiring?

Often the largest risk to any bear thesis is what we call “stupid money risk”, which means an acquirer comes in and pays for GDDY at the current, or higher, share price despite the stock being overvalued. An acquisition could come from another firm in the domain registration industry or web hosting platform looking to increase its presence in the market. However, as domain registration grows more commoditized an acquisition may be less likely now than in the past. Any firm looking to acquire GDDY would be imprudently allocating capital and destroying substantial shareholder value in an acquisition.

We show below how expensive GDDY remains even after assuming an acquirer can achieve significant synergies.

Walking Through the Acquisition Value Math

To begin, GoDaddy has liabilities of which investors may not be aware that make it more expensive than the accounting numbers suggest.

- $146 million in net deferred tax liabilities (2% of market cap)

- $115 million in off-balance-sheet operating leases (1% of market cap)

- $60 million in minority interests (1% of market cap)

After adjusting for these liabilities, we can model multiple purchase price scenarios. Even in the most optimistic of scenarios, GDDY is worth less than its current share price.

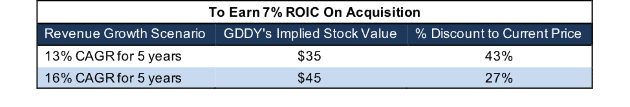

Figures 7 and 8 show what we think Alphabet (GOOGL) should pay for GDDY to ensure it does not destroy shareholder value. While purely hypothetical, acquiring GDDY would immediately enhance Google’s domain registration business while providing a “one-stop shop” from registration to site building to email and applications via Google Drive. However, there are limits on how much GOOGL would pay for GDDY to earn a proper return, given the NOPAT or free cash flows (or lack thereof) being acquired.

Each implied price is based on a ‘goal ROIC’ assuming different levels of revenue growth. In both scenarios, the estimated revenue growth rate is 17% in year one and 12% in year two, which is the consensus estimate for GDDY’s revenue growth. For the subsequent years, we use 12% in scenario one because it represents a continuation of consensus estimates. We use 18% in scenario two because it assumes a merger with GOOGL would create additional revenue opportunities through increased search marketing and cross-selling of existing GOOGL services.

We conservatively assume that GOOGL can grow GDDY’s revenue and NOPAT without spending anything on working capital or fixed assets beyond the original purchase price. We also assume GDDY immediately achieves a 12% NOPAT margin, which is the average of GOOGL and GDDY’s margins. For reference, GDDY’s 2017 NOPAT margin is just 2%, so this assumption implies immediate improvement and allows the creation of a truly best-case scenario.

Figure 7: Implied Acquisition Prices for GOOGL to Achieve 7% ROIC

Sources: New Constructs, LLC and company filings.

Figure 7 shows the ‘goal ROIC’ for GOOGL as its weighted average cost of capital (WACC) or 7%. Even if GDDY can grow revenue by 16% compounded annually, with a 12% NOPAT margin for the next five years, the firm is worth less than its current price of $61/share. It’s worth noting that any deal that only achieves a 7% ROIC would only be value neutral and not accretive, as the return on the deal would equal GOOGL’s WACC.

Figure 8: Implied Acquisition Prices for GOOGL to Achieve 31% ROIC

Sources: New Constructs, LLC and company filings.

Figure 8 shows the next ‘goal ROIC’ of 31%, which is GOOGL’s current ROIC. Acquisitions completed at these prices would be truly accretive to GOOGL shareholders. Even in the best-case growth scenario, the implied stock value fails to reach $0/share, mainly because of GDDY’s large liabilities noted earlier and its debt load. Even assuming this best-case scenario, GOOGL would destroy over $10 billion by purchasing GDDY at its current valuation. Any scenario assuming less than 16% compound annual growth in revenue would result in further capital destruction for GOOGL.

Further Commoditization or Missed Expectations Could Send Shares Lower

As more domain registries enter the industry, the race to the bottom for profit margins becomes inevitable. There are few differentiating features when registering domains, and pricing is mostly regulated. Additionally, the number of free and premium website creation tools challenges growth in that business segment. As noted earlier, with margins near the bottom of the industry, GoDaddy can ill afford any further pricing pressure while its limited cash levels leave it with limited ability to continue enhancing its platform.

Beyond industry trends, GoDaddy’s earnings could prove a negative catalyst as well. Over the past year, 2018 consensus expectations have fallen dramatically, from $0.83/share in April 2017, to $0.42/share in April 2018. Healthy companies can consistently generate and grow profits. GoDaddy’s business has done the opposite, and any future earnings miss could send shares lower.

While we don’t attempt to predict exactly when the market will recognize the disconnect between expectations and reality, such a realization could severely damage investors’ portfolios.

Insider Trading Fails to Inspire Confidence and Short Interest Are Minimal

Over the past three months, 18.3 million insider shares have been purchased and 27.8 million have been sold for a net effect of 9.5 million insider shares sold. These sales represent 7% of shares outstanding and fail to create confidence in the long-term prospects of the business.

Short interest is currently 4.5 million shares, which equates to 3% of shares outstanding and three days to cover. Short interest rose 7% over the prior month and remains near its 52-week high. Short interest could rise if earnings fail to beat expectations or a dilutive capital raise is announced.

Critical Details Found in Financial Filings By Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings. Below are specifics on the adjustments we make based on Robo-Analyst findings in GoDaddy’s 2017 10-K:

Income Statement: we made $279 million of adjustments, with a net effect of removing $86 million in non-operating income (4% of revenue). We removed $196 million in non-operating income and $110 million in non-operating expenses. You can see all the adjustments made to GDDY’s income statement here.

Balance Sheet: we made $1.3 billion of adjustments to calculate invested capital with a net decrease of $623 million. One of the largest adjustments was $432 million related to midyear acquisitions. This adjustment represented 11% of reported net assets. You can see all the adjustments made to GDDY’s balance sheet here.

Valuation: we made $3.2 billion of adjustments with a net effect of decreasing shareholder value by $2.2 billion. Apart from $2.6 billion in total debt, which includes $115 million in operating leases, the most notable adjustment to shareholder value was $146 million in deferred tax liabilities. This adjustment represents 2% of GDDY’s market cap.

Unattractive Funds That Hold GDDY

The following funds receive our Unattractive-or-worse rating and allocate significantly to GoDaddy Inc.

- Columbia Acorn Select Fund (LTFAX) – 4.3% allocation and Unattractive rating

- Victory RS Select Growth Fund (RSDGX) – 2.2% allocation and Very Unattractive rating

- Goldman Sachs Hedge Industry VIP ETF (GVIP) –2.2% allocation and Unattractive rating

- Eaton Vance Tax-Managed Multi-Cap Growth Fund (EACPX) – 2.2% allocation and Unattractive rating

- Penn Capital Managed Alpha SMID Cap Equity Fund (PSMPX) – 2.1% allocation and Very Unattractive rating

This article originally published on April 16, 2018.

Disclosure: David Trainer, Kyle Guske II, and Sam McBride receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

Click here to download a PDF of this report.

Photo Credit: geralt (Pixabay)