We published an update on this Long Idea on May 4, 2022. A copy of the associated Earnings Update report is here.

We published an update on this Long Idea on April 21, 2021. A copy of the associated Earnings Update report is here.

JPMorgan Chase & Company (JPM:$152/share) is this week’s Long Idea as well as one of our original “See Thru the Dip” picks. We think investors are not seeing the value in JP Morgan Chase’s ability to leverage technology to strengthen its deep competitive advantages over peers and fintech start-ups like Square, Inc. (SQ: $225/share).

Even after soaring 68% since our Long Idea report in May 2020, JPMorgan Chase’s stock remains undervalued. JPM presents quality risk/reward given:

- The firm enters the fintech market with scale that first movers may never achieve.

- Huge cash flows fuel the firm’s large fintech investment advantage and drive its fast follower strategy.

- Past technology investments drive cost efficiencies which improve existing competitive advantages.

- Expectations for JPM and SQ remain disconnected from fundamentals.

Big Banks Will Win the "Fintech Revolution"

Though the financial services industry has experienced significant innovation in recent years, much of that innovation is not as disruptive as start-up firms would have you believe. As we explained in October 2017, big banks co-opted the "Fintech Revolution." Big banks have the financial resources, swaths of user and transaction data, necessary regulatory approvals, and customer relationships to sustain a large, technologically-driven advantage over smaller firms. JPMorgan Chase is the biggest and the best.

It Doesn’t Always Pay to Be First

First movers in an industry can build an early technological advantage, but typically begin in niche markets. Once the new technology gains more widespread acceptance, the market moves beyond niche players. As profitability improves, bigger firms become attracted to the market and enter at scale (think Tesla (TSLA) vs. General Motors (GM) in the electric vehicle market).

As a first mover in facilitating small business transactions, Square has quickly grown its gross payment volume (GPV) from $6.5 billion in 2012 to $113 billion in 2020. However, being first to market and gaining market share doesn’t mean a business can sustain profits. Over the past eight years, Square has only generated positive net operating profit after-tax (NOPAT) once, in 2019. While big banks have undoubtedly observed Square’s rapid GPV growth, they have also noticed its lack of profitability.

However, with Square’s revenue doubling in 2020 and reaching 7% of JPMorgan Chase’s 2020 revenue, the market looks sizeable enough for JPMorgan Chase’s entry, and Square’s first mover advantage is all but gone.

JPMorgan Chase Beats Square on Day 1

JPMorgan Chase announced in Oct 2020 its new QuickAccept service that allows businesses to process credit cards through a mobile app or a contactless reader, which places it in direct competition with Square.

JPMorgan Chase can migrate a “large portion” of its more than three million existing small-business customers to QuickAccept, and enter the market with more scale than Square, which has just over 2 million merchants using its point-of-sale service.

Best of all for customers, JPMorgan Chase is offering free same-day funding on sales made through QuickAccept, something for which Square charges 1.5%. Simply put, from day one, JPMorgan Chase offers a comparable service to a larger number of customers at a lower price. Since Square processed $103.7 billion of payments in 2020, its merchants could save $1.5 billion (1.5% of payments processed) and access their money faster by switching to QuickAccept.

Huge Digitally Active User Base Creates Immediate Scale Advantages

JPMorgan Chase’s ability to quickly integrate QuickAccept at such a large scale highlights how its established customer base provides the firm with a major advantage over companies like Square. In the U.S. alone, JPMorgan Chase serves half of the country’s nearly 123 million households including 55 million “digitally active customers.”

The firm can continue to expand its digital product offerings and distribute those products immediately to its market-leading customer base with little to no marketing costs.

War Chest of Cash Raises Barriers to Entry

JPMorgan Chase’s long-standing relationships with a large customer base enables the firm to generate lots of cash, which allows the firm to heavily invest in technology/new products and even afford to give that technology to customers for free.

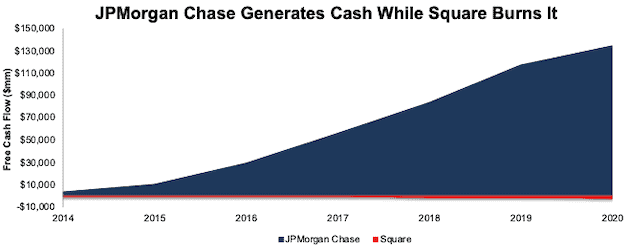

Since 2014, JPMorgan Chase generated $134.4 billion (29% of market cap) in cumulative free cash flow (FCF). On the other hand, Square burns cash. Since 2015, Square has burned a cumulative $2.1 billion (2% of market cap) in FCF.

Figure 1: JPMorgan Chase vs. Square: Cumulative Free Cash Flow Since 2014

Sources: New Constructs, LLC and company filings.

Market Expectations Imply Square Wins the “Fintech Revolution” & JPMorgan Chase Will Lose

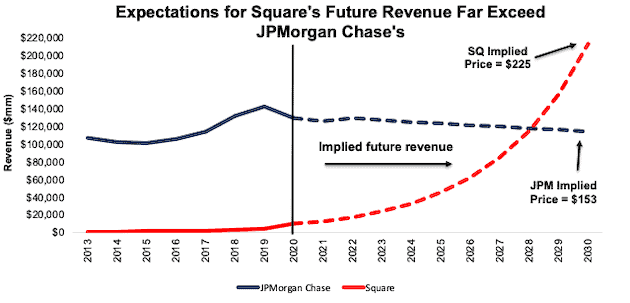

Despite the competitive advantages JPMorgan Chase holds over startups and incumbents alike, the expectations baked into the valuation of Square imply it will be the winner of the “Fintech Revolution.” Below, we use our reverse discounted cash flow (DCF) model to highlight the disconnect in the future revenue and profit growth expectations baked into JPMorgan Chase’s and Square’s current stock prices.

To justify JPMorgan Chase’s current price of $152/share, we show that the market assumes:

- NOPAT margin falls to 26% (equal to its five-year average versus 31% TTM) and

- revenue falls 1% compounded annually for the next decade, which assumes revenue falls 3% in 2021, grows 3% in 2022 (equal to consensus estimates) and falls 1.5% a year each year thereafter.

In this scenario, JPMorgan Chase’s revenue ten years from now is $114.1 billion, or 12% below its 2020 revenue and nearly equal to its 2017 revenue. See the math behind this reverse DCF scenario.

On the other hand, to justify its current price of $225/share, Square must:

- immediately achieve a NOPAT margin of 5% (above its all-time high margin of 3.5%, compared to -1% TTM) and

- grow revenue by 37% compounded annually over the next ten years. For reference, average consensus estimates expect Square’s revenue to grow 23% compounded annually from 2021 to 2025.

In this scenario, Square’s revenue ten years from now is $213 billion, or 65% greater than JPMorgan Chase’s 2020 revenue and nearly 10-times greater than PayPal’s (PYPL) 2020 revenue. See the math behind this reverse DCF scenario.

This scenario implies that Square’s GPV in 2030 will equal $7.4 trillion, or 59% of all U.S. consumer spending in 2020[1].

Figure 2 compares the historical and implied future revenues implied by the current stock prices of JPMorgan Chase and Square.

Figure 2: Share Prices Imply Square’s Revenue Overtakes JP Morgan Chase’s

Sources: New Constructs, LLC and company filings.

This scenario also assumes Square is able to grow revenue, NOPAT, and FCF without increasing working capital or fixed assets. This assumption is unlikely but allows us to create best-case scenarios that demonstrate how high expectations embedded in the current valuation are. For reference, Square’s invested capital increased by 33% compounded annually since 2013.

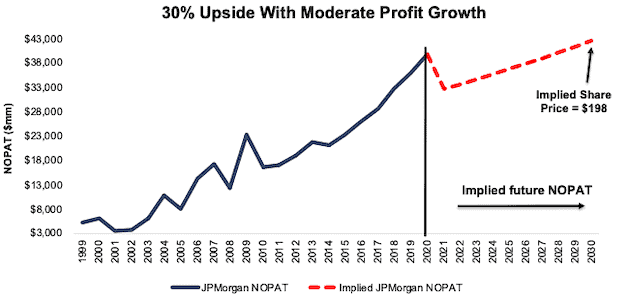

JPM Has 30% Upside With Moderate Growth

Given the disconnect in valuation, the upside potential in owning JPM is much larger than SQ. If we assume JPMorgan Chase’s:

- NOPAT margin falls to 26% (equal to its five-year average margin and compared to 31% TTM) and

- Revenue grows by just 2% compounded annually over the next decade, which assumes revenue falls 3% in 2021, grows 3% in 2022 (equal to consensus estimates) and grows by just 3% compounded annually each year thereafter, then

the stock is worth $198/share today – a 30% upside to the current stock price. See the math behind this reverse DCF scenario. For reference, JPMorgan Chase has grown revenue by 3% compounded annually over the past two decades. Figure 3 compares JPMorgan Chase’s historical NOPAT with the implied NOPAT in this scenario.

Figure 3: JPMorgan Chase’s Historical vs. Implied NOPAT

Sources: New Constructs, LLC and company filings.

Technology Grows JPMorgan Chase’s Top Line…

JPMorgan Chase’s investments in blockchain, artificial intelligence, machine learning, cybersecurity, and cloud computing enable the firm to increase the breadth and depth of its offerings and reach a larger number of customers. Focusing on faster transaction processing, better customer responsiveness, and more targeted offers, JPMorgan Chase aims to keep its existing customers and attract new ones to continue growing its revenue.

The firm is also expanding its customer base to new markets. JPMorgan Chase recently announced its entry into the retail banking market in the U.K, but it will not be launching a traditional brick-and-mortar banking presence. Rather, it is leveraging its investment in technology by launching a digital-only bank.

Beyond entering new markets and attracting customers, not all of JPMorgan Chase’s revenue growth will be organic. Acquisitions can provide new opportunities or improve existing services as well. Unlike the past where banking acquisitions typically meant a bigger bank acquiring the assets of a smaller bank, future acquisitions for JPMorgan Chase are likely to be technology focused like its acquisition of WePay and more recently 55ip.

…and Its Bottom Line

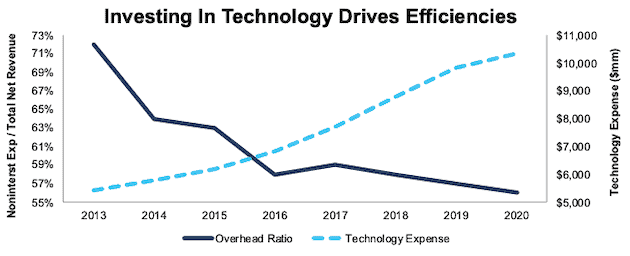

Perhaps the greatest immediate and long-term advantage JPMorgan Chase gains from investing in technology and/or fintech is more cost efficiencies. As the firm incorporates more technology, its operations require less noninterest overhead expense. To measure the efficiency of the firm’s operations, we evaluate its overhead ratio, which equals noninterest expense / total net revenue. Per Figure 4, as JPMorgan Chase has increased its investment in technology, its overhead ratio has fallen from 72% in 2013 to 56% in 2020.

Figure 4: JP Morgan Chase: Overhead Ratio vs. Technology Expense Since 2013

Sources: New Constructs, LLC and company filings.

JPMorgan Chase’s Profitability Is Superior to Traditional Banks’ and Square’s

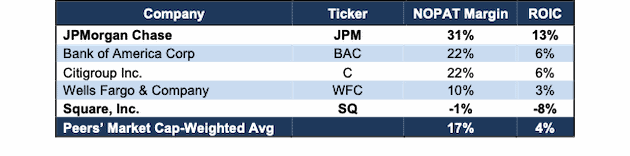

As noted above, implementing technology at scale helps drive JPMorgan Chase’s leading profitability. Its TTM NOPAT margin of 31% and return on invested capital (ROIC) of 13% not only dwarf Square’s, but also traditional banking peers’, including Bank of America Corp (BAC), Citigroup Inc. (C), and Wells Fargo & Company (WFC).

Per Figure 5, JPMorgan Chase’s NOPAT margin of 31% and ROIC of 13% are much higher than its peers’ and Square’s. As JPMorgan Chase integrates even more fintech into its operations, we expect its scale advantage to continue to drive superior profitability.

Figure 5: JPMorgan Chase vs. Peers: NOPAT Margin & ROIC

Sources: New Constructs, LLC and company filings.

Keep These Winners & Sell These Losers

There are micro-bubbles outside of fintech. Figure 6 shows all of our micro-bubble winners and losers.

Figure 6: Micro-Bubble Winners & Micro-Bubble Stocks

| Micro-Bubble Winners | Micro-Bubble Losers | Report Date |

| Not one specific winner | Spotify Technology (SPOT) | 3/1/21 |

| General Motors Co (GM) | Tesla Inc (TSLA) | 2/18/21 |

| Kellogg Company (K) | Beyond Meat Inc. (BYND) | 2/16/21 |

| Hyatt Hotels Corp (H) | Airbnb, Inc. (ABNB) | 2/10/21 |

| Williams-Sonoma Inc. (WSM) | Wayfair, Inc. (W) | 2/3/21 |

| Sysco Corporation (SYY) | DoorDash, Inc. (DASH) | 1/27/21 |

| Alphabet, Inc. (GOOGL) | GoDaddy Inc (GDDY) | 9/26/18 |

| Microsoft Corporation (MSFT) | Dropbox Inc. (DBX) | 9/26/18 |

| General Motors Co (GM) | Tesla Inc (TSLA) | 8/16/18 |

| The Walt Disney Company (DIS) | Netflix Inc. (NFLX) | 8/16/18 |

| Oracle Corporation (ORCL) | Salesforce.com Inc. (CRM) | 8/16/18 |

| Walmart, Inc. (WMT) | Amazon.com Inc. (AMZN) | 8/16/18 |

Sources: New Constructs, LLC and company filings.

This article originally published on March 10, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] In 4Q20, Square generated $929 million in transaction-based fees from $30.0 billion of GPV. We derive Square’s implied 2030 GPV of $7.4 trillion by dividing the firm’s implied 2030 revenue by its 4Q20 transaction-based fee rate of 2.9%. U.S. consumer spending in 2020 is estimated at $12.5 trillion.