Weighted Average Cost of Capital (WACC)

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics. Here’s proof from some of the most respected public & private institutions in the world.

Weighted average cost of capital (WACC) is the weighted average of the costs of all external funding sources for a company.

WACC plays a key role in our economic earnings calculation. It is hard to be 100% certain about the exact cost of a company’s capital. Our guiding principle when calculating WACC is that it is better to be vaguely right than precisely wrong. We make sure that WACCs are reasonable first and employ many rules to normalize the inputs to WACC to ensure none of them cause an abnormal WACC to occur in any of our models.

The formula for WACC is in Figure 1.

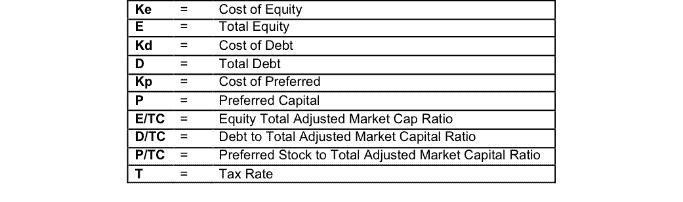

Figure 1: How To Calculate WACC

(Ke) * (E/TC) + (Kd * (1-T)) * (D/TC) + Kp * (P/TC)

where:

Sources: New Constructs, LLC and company filings

Below we provide the details behind our WACC calculations.

Cost of Equity

- Our cost of equity calculation is based on the Capital Asset Pricing Model methodology.

- We use the market value of equity when calculating all Total Adjusted Market Capital ratios.

- The Equity Risk Premium is calculated as the average of the current implied Equity Risk Premium and the historical implied Equity Risk Premium.

- Though there are many other more complicated approaches for arriving at a firm’s cost of equity, we do not feel their additional complexity offers commensurate accuracy. CAPM is simple, gets us close enough and it is easy to implement consistently across all companies we analyze.

- For Beta, we use consistent values to avoid this variable having an inappropriately large impact on the WACC calculation. We apply industry and sector averages for beta to individual companies. Industry and sector averages are based on the actual individual company betas, which we calculate based on daily prices over the past 5 years. We assign the industry or sector averages where we see individual beta values clustered most uniformly within industries or sectors, respectively.

Cost of Debt

- The cost of debt capital should represent the business’ long-term marginal borrowing rate.

- The Risk-Free Rate (RFR) is approximated by the 5-year zero-coupon STRIPS.

- To the RFR, we add the debt spread associated with the debt rating on the company’s long-term debt.

- The resulting pre-tax cost of debt is then multiplied by (1 – marginal tax rate).

If a company fails to generate a return on invested capital (ROIC) greater than its WACC, it is destroying shareholder value. Figure 2 shows which companies have the highest and lowest WACCs.

Want To Learn More?

Sign up to receive free alerts about all our new research reports including Long Ideas and Danger Zone picks.

See our webinar on importance of ROIC and how to calculate it.

Here is our report on "ROIC: The Paradigm For Linking Corporate Performance to Valuation."