Net Operating Profit After Tax (NOPAT) & NOPAT Margin

Metrics are only as good as the data that drive them. The best fundamental data in the world drives our metrics. Here’s proof from some of the most respected public & private institutions in the world.

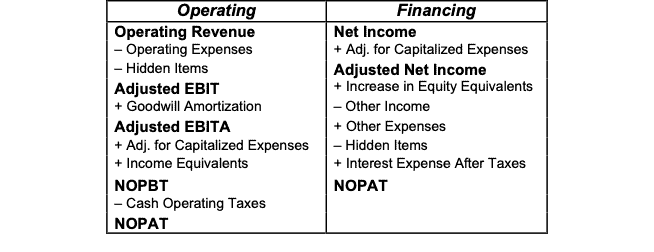

Net operating profit after-tax (NOPAT) is the unlevered, after-tax operating cash generated by a business. It represents the true, normal and recurring profitability of a business. GAAP earnings or, even worse, non-GAAP earnings, are highly unreliable and are subject to misleading management manipulation.

As the numerator in our return on invested capital (ROIC) calculation, NOPAT is a very important value, and we place a great deal of importance on getting it right. Figure 1 provides the simplified formula for calculating NOPAT.

Figure 1: How to Calculate NOPAT – Simplified

Sources: New Constructs, LLC and company filings

When we calculate NOPAT, we make numerous adjustments to close accounting loopholes and ensure apples-to-apples comparability across thousands of companies. A company shouldn’t be able to hide its true performance, such as hidden, unusual losses.

Want To Learn More?

Sign up to receive free alerts about all our new research reports including Long Ideas and Danger Zone picks.

See our webinar on importance of ROIC and how to calculate it.

Get our report "ROIC: The Paradigm For Linking Corporate Performance to Valuation."